When Doordash started as an American food delivery service in 2013, Grubhub was already the market leader. By Mid 2018, Uber Eats had overtaken Grubhub in market share. But the Uber Eats growth fizzled, and Grubhub could never catch up. By 2021, Doordash controlled 56% of the US food delivery market; Uber Eats and Grubhub accounted for only 26% and 16%.

This begs the question: how did Doordash become the market leader by attacking a problem considered already solved?

In this piece, we will first learn how Doordash differentiated itself to carve out a place for itself, see how Doordash has expanded beyond facilitating just restaurant deliveries, and take a look at Doordash’s business model.

DoorDash Founding & Growth Story

The Doordash story began at a macaroon store in downtown Palo Alto in the fall of 2012. Before starting Doordash, the four founders, Standford students, had built an app for small businesses and were collecting feedback.

They had just spent a long time talking to Chloe, the store manager of the macaroon store, learning about her day-to-day life. But the app that they had built didn’t solve her most fundamental problem.

She highlighted that the store’s most significant problem was the inability to handle deliveries. And it was this insight that led to Doordash’s lightbulb moment. They interviewed 200 more small businesses and realized that almost everyone faced the delivery problem.

Back then, food delivery was standard in big cities, but none of the restaurants in Palo Alto delivered food. Instead of spending time building a sophisticated product, they launched with just a simple landing page called PaloAltoDelivery.com after just an afternoon’s worth of work. The website had a few restaurant menus sourced from the internet and a personal phone number of one of the founders.

In the beginning, the four founders would make the deliveries themselves. But as orders grew, the founders began to outsource the deliveries to a group of independent drivers it calls Dashers. And this was one of the critical factors that helped DoorDash differentiate itself and grow its market share. Up until then, older players like Grubhub functioned more like a restaurant listing site, with the restaurants themselves taking care of delivery.

Two months after the launch of the simple landing page, DoorDash had raised $120,000 in seed funding from YCombinator, one of the US’s most credible startup accelerators. Here’s a video of one of the founders pitching DoorDash in the YCombinators 2013 Demo Day.

By June 2013, PaloAltoDelivery.com became DoorDash. Close to the end of 2013, in October, DoorDash raised $2.4 million from heavyweight investors like Khosla Ventures, Charles River Ventures, SV Angel, Paul Buchheit, Pejman Mar Ventures, Andy Rachleff, and Russell Siegelman.

The money raised from this and subsequent funding rounds was used for geographical expansion within the US. By 2015, DoorDash was available in 18 cities across the US. In the same year, it raised a Series B round of $40 million at a valuation of $600 million and launched operations in Canada, its first international market.

In Dec 2016, Doordash expanded beyond food delivery by launching DoorDash Drive, a fulfillment service that allows non-restaurant merchants to use DoorDash’s delivery fleet.

In a blog announcing the launch of Drive, Abhay Sukumaran, Doordash Product Manager, wrote,

“From the very start, DoorDash was founded with the goal of being the local logistics layer for every city. To get there, we began by building a consumer-facing marketplace focused on possibly the most complicated item to deliver correctly: food. Over the past three years we’ve been learning from millions of deliveries, training our data models, and building the technology to get food delivery right. While we continue to double down on restaurant delivery by signing new partners and expanding to new markets, we’ve also been building the tools necessary to support additional types of deliveries through DoorDash and to bring us one step closer toward our ultimate goal of delivering anything from anywhere.”

DoorDash launched a subscription product called DashPass in 2018 and an online store convenience store called Dashmart in 2020 (more on both of these when we dive into Doordash’s business model below)

After US & Canada, Doordash also expanded to Australia in 2019 and Japan in 2021. DoorDash has also been involved in three major controversies — a misleading tipping policy that led to a $2.5 million lawsuit settlement, a data breach that impacted 4.9 million customers, delivery workers & restaurants & ongoing antitrust allegations.

DoorDash Business Model

Doordash makes money from the following sources: commissions paid by partner merchants, delivery fees charged to customers, membership fees paid by consumers for DashPass subscription to eliminate regular delivery fees, per order fees from non-marketplace merchants using Drive (DoorDash’s logistics service), & providing catering services to businesses.

Let’s look at each of these revenue sources individually to better understand DoorDash’s business model.

Commissions

Restaurant Owners are charged commission as a percentage of the total order amount, depending on the merchant plan subscription.

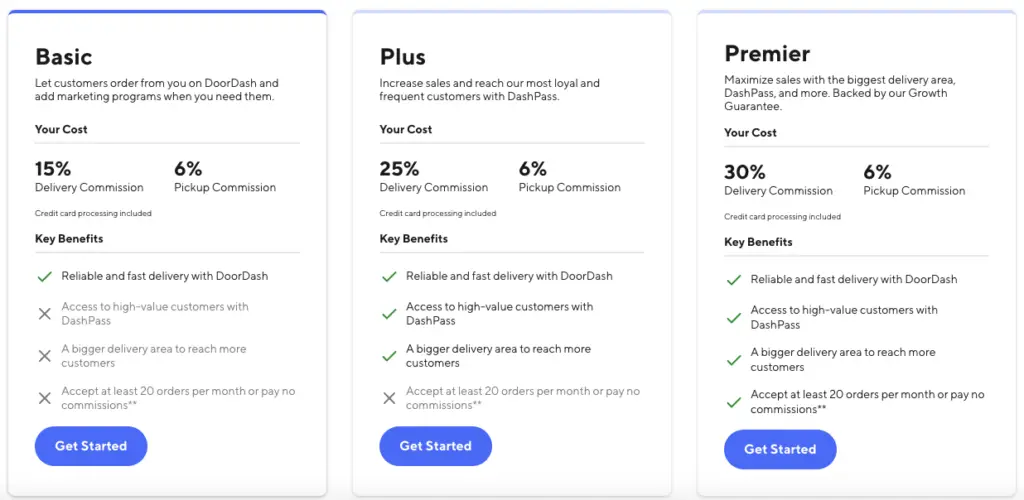

Restaurants can opt for either of three plans: Basic, Plus, and Premium.

In the basic plan, including delivery and pickup commission, restaurants pay Doordash a cumulative 21% commission. In the Premier plan, the commission increases to a cumulative 36%.

Apart from charging commissions to partner restaurants, Doordash also charges commissions to merchants selling convenience products through Dashmart, an online convenience store that aggregates products sold by merchants like 7-Eleven, CVS, Walgreens, Wawa, and many more.

I could not find the commission percentage levied on convenience store merchants. However, as a general rule, one could expect commissions to be lower in the case of big brands due to the disproportionate negotiating leverage commanded relative to smaller brands.

Delivery Fees

In exchange for facilitating deliveries, Doordash charges delivery fees to customers. Apart from delivery fees, customers are also charged a relatively smaller service fee, which covers technology cost, market cost & payment processing.

DashPass

A subscription product, DashPass, allows subscribers unlimited orders with a $0 delivery fee and reduced service fee from eligible merchants. DashPass costs $9.99 for a monthly membership.

DashPass serves a twofold purpose — giving Doordash the capability to extract more value from loyal customers and incentivize merchants to upgrade to plus and premium commission plans because these loyal customers are only made accessible to merchants subscribed to those two tiers, not the basic tier.

Drive

DoorDash’s white-label logistics service, Drive, helps merchants fulfill consumer demand they can’t handle in-house by giving them access to DoorDash’s fleet of drivers. Merchants like Chipotle, Wingstop, and LittleCaesars generate significant orders but do not manage their own logistics operations. These merchants leverage Doordash’s logistical fleet to fulfill orders and pay a flat fee per order in exchange.

DoorDash For Work

DoorDash For Work is a subscription service targeted at companies looking to subsidize food costs for employees. It gives employees $0 delivery fees and reduced service fees on eligible orders.

DoorDash Revenue

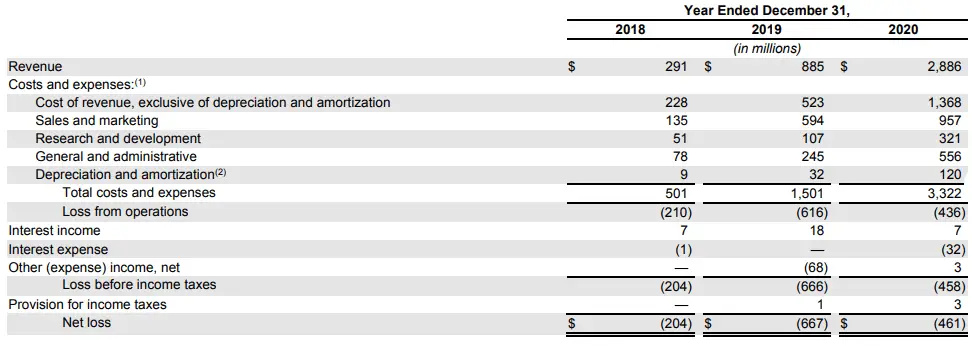

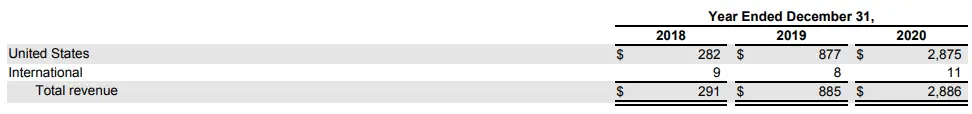

In 2020, DoorDash made a revenue of $2.8 billion, up 226% from the $885 million it made in 2019.

While Doordash is yet to attain profitability, losses reduced from $667 million in 2019 to $461 million in 2020. Loss incurred in 2020 is higher than the $204 million loss incurred in 2018, but 2020 saw the best revenue to loss ratio, majorly aided by the unprecedented growth in online food ordering due to the pandemic.

Regarding geographical revenue, 99.62% of DoorDash’s revenue came from the US alone, with international markets contributing only 0.38%.

This large delta between US & international revenue indicates how much growth potential exists for Doordash outside the US, provided it can cement its position in new markets.

Apart from revenue and loss, total order volume and Marketplace GOV are two other key Doordash metrics — both of which saw significant growth in 2020.

In 2020 alone, Doordash received 816 million total orders, which amounted to a total Marketplace GOV of $24.7 billion.

DoorDash Funding, Valuation & Acquisitions

In 12 funding rounds, Doordash has raised a total of $2.5 billion. Their latest funding was raised on Jun 18, 2020, from a Series H round.

In Dec 2020, DoorDash went public on the NYSE (New York Stock Exchange) at a $72 billion valuation. At the time of writing this, DoorDash’s stock is trading at half of the price compared to what it went public, meaning valuation would also be close to half at around $36 billion.

Up until 2022, DoorDash has made 7 seven acquisitions. Notable acquisitions include

— Caviar: a service focussed on providing food delivery from upscale urban-area restaurants that typically do not deliver

— Chowbotics: a robotics company famous for its salad-making robot.

— Scotty Labs: a company focused on self-driving and remote-controlled vehicle technology

— Wolt: a Finland-based food delivery company with operations majorly in Europe

— Bbot: a contactless order and pay solution startup

Read More Case Studies

Netflix Business Model Case Study

Snapchat Business Model Case Study

Instagram Business Model Case Study