When Droom started in 2014, the used vehicle market was already a competitive space with specialists like CarTrade, Carwale, Cardekho, Zigwheel, and generalists like Quikr and OLX. Because the market was already crowded, one would assume that entering the space would be an unwise undertaking. But Sandeep Aggarwal, founder of Droom, saw the existence of competitors as validation of his thesis of starting a used car marketplace. On the back of the successful execution of his idea, Sandeep proved that he was right. Today, Droom features among the top 5 players in revenue in the used car market, making it a case study worthy of attention.

So, in this business case study, I will walk you through the founding and growth story of Droom, Droom’s business model, and wrap up by discussing its future growth potential.

Droom Founding & Growth Story

When Sandeep decided to start Droom in 2014, he was not a first-time entrepreneur. He had already co-founded Shopclues, an Indian online marketplace, in 2011. By 2015, Shopclues was valued at $1.1 billion. Sandeep stepped down from his role as CEO after he was slapped with an insider trading case in 2013. After pleading guilty and settling the case with a fine, Sandeep decided to start from scratch by building Droom.

In April 2014, Sandeep came up with the idea for Droom. By June 2014, Droom had raised its first round of capital even before launching its website or app. Having already started a successful company worked in favor of Sandeep when it came to investor backing.

Droom launched its android app in November 2014 and its website in February 2015. By November 2015, Droom crossed Rs 300 crore in annualized GMV ( total value of merchandise sold on the platform). By Dec 2015, more than 20,000 sellers were using Droom.

Until the end of 2015, Droom focused on building the barebones of a marketplace that only facilitated used vehicle transactions. From 2016, Droom started taking the approach of building an entire ecosystem around the car.

At the beginning of the year, Droom launched a new vehicle inspection service called Eco to remove information asymmetry from the purchase cycle. In a traditional used car transaction, buyers would have to trust the seller’s word on the vehicle’s condition. With Droom’s Eco service, car experts would analyze the car and give a detailed report to the buyer.

In the same year, Droom launched two more useful products: Orange Book Value and Droom History. Orange Book Value is a vehicle pricing engine is like the Kelley Blue Book Value of the US. At the time of writing, OBV is present in 38 countries & 11 languages, having served 525 million queries.

As is evident in the name, Droom History is a tool that allows consumers to check historical records on used vehicles, including things like water damage, accident history, number of owners, and more.

Partnering with automobile companies, Droom also launched the new vehicle category in 2016. Towards the second half of the year, Droom crossed 100 crores in GMV.

2017 was the year Droom entered the financial services domain with its loan offering Droom Credit. In the same year, the company also launched Droom Discovery, a tool to aid buyers in the research phase of the purchase journey.

Having reached a GMV of 4100 crores by March 2018, Droom had strengthened its roots enough in India to eye simultaneous international expansion. Towards the end of the year, Droom started operations in Malaysia and Singapore.

In 2019, the Droom launched Insurance, further enhancing its existing financial offerings. As Droom has grown, the types of vehicles listed on the platform have also increased. At the time of writing, the platform even supports buying and selling bicycles, planes, buses & trucks apart from the usual two and four-wheelers. As per Droom, more than 1.15 million vehicles were listed on the platform as of September 30, 2021.

Droom Business Model

Droom makes money from the following five sources: commission on vehicle sales, dealer subscriptions, financial services like Insurance and loans, premium tools & advertising. In FY21, Droom reported generated revenue of Rs 135.52 crores against 181.37 crores in FY20. Net loss narrowed from 89.60 crores in FY20 to Rs 68.88 crores in FY21.

Now, let’s look at each of Droom’s revenue sources individually to develop a better understanding of Droom’s business model.

Vehicle Sales Commission: On every successful vehicle transaction, Droom takes a cut of 1.75% to 2.5% with the exact commission amount depending on the type of vehicle ( car, bike, etc.).

Financial Services: Because customers are already buying vehicles through Droom, it has an added advantage in offering loan and insurance services. These services also help strengthen Droom’s positioning as a vehicle ecosystem enables rather than just an ordinary marketplace connecting buyers and sellers.

Premium Tools: Droom offers several paid premium tools like Orange Book Value(Pricing Report), vehicle inspection services, vehicle History certificates, and more.

Dealer Subscriptions: Droom offers a free basic plan to auto dealers. But for bigger dealers who want to avail premium services, Droom sells a subscription service under two different plans: pro-seller premium and pro-seller business.

Advertising: Droom gets 36 million monthly visitors on its platform, and the website ranks 4th in the vehicle category in India. Since Droom gets high-quality and intent-driven visitors on its properties, the platform’s real estate is valuable to vehicle advertisers. Advertising solutions provided by Droom include Pre-launch Hype, Launch Sale and Flash Sale, Branding, Buyback Solutions, Lead Solutions, and more.

As per its advertising page, the company has worked with brands like Ford, Uber, Zoomcar, HeroFinCorp, and more. In the future, Droom expects its ad segment to contribute 20% to 30% of GMV. And considering automobile ranks in the top three largest verticals in terms of advertising spend, the projections seem reasonable.

Droom Funding, Valuation & IPO

Since its inception, Droom has raised $333 million in 8 funding rounds. When Droom raised its last funding round of $200 million, it was valued at $1.2 billion.

In November 2021, Droom had filed preliminary papers with SEBI (The Securities and Exchange Board of India) to raise Rs 3000 crore through an initial share sale. According to the DHRP ( draft red herring prospectus ) filing, Droom’s IPO comprises fresh issuance of equity shares worth Rs 2000 crores and an offer to sell Rs 1,000 crore worth of shares by promoter Droom Pte Ltd.

Droom plans to use the money raised from the IPO to fund organic & inorganic growth initiatives and general corporate expenses.

Droom Future Potential

To assess Droom’s future, we need to consider two main factors: the size of the automobile market & Droom’s standing amongst the competition.

When it comes to automobiles, India is the fourth-largest market after the US, China & Japan. As of 2019, only 5% of Indians had a car and 25% had two-wheelers, meaning there’s still huge room for vehicle adoption in the country even if were to account for the growth that might have occurred since. But what’s interesting is that the used car segment is bigger in India than the new car market. In FY2021, the used car sector in India stood at 3.8 million units, 1.5x bigger than the 2.6 million new car market. While both the used car and new car segments are supposed to grow, the used car segment will significantly outgrow the new car segment as per Autocar India.

When Droom started, only 0.1% of automobile transactions were online. Even now, less than 1% of the market is online, but the numbers are expected to grow. So, both from the perspective of automobile market growth and online transaction shift, Droom has a huge opportunity if we were to factor only the size of the market.

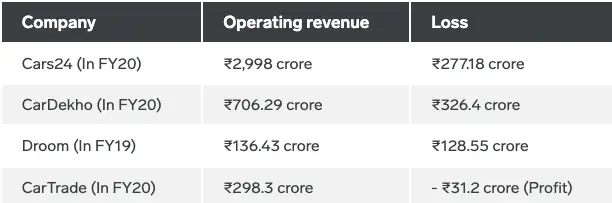

But Droom also faces competition primarily from three other major players — Cars24, Cardekho & Cartrade. Here’s what the financials for all these companies looked like in FY20.

The above image mentions FY19 revenue for Droom, so to make a fair comparison, Droom made 181.37 crores in revenue and a loss of 89.40 crores in FY20. As one can make out from purely an existing revenue generation standpoint, Droom has yet a lot of catching up to do.

Will Droom be able to catch up and race ahead of the competition? Only time will tell.

Read More Case Studies

Zerodha Business Model Case Study

YouTube Business Model Case Study

Tesla Business Model Case Study