Over the last three decades, we have been through two browser wars, and we are likely on the cusp of the third one.

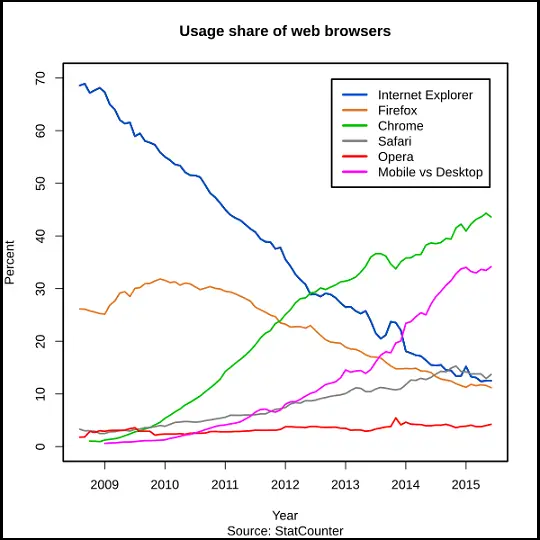

The first browser war ended with Microsoft’s Internet Explorer defeating Netscape Navigator, becoming the market leader in 1998. The second browser war ended with Google Chrome dethroning Internet Explorer, becoming the market leader in 2012.

A key player of the second browser war, Firefox‘s browser market share peaked at 32.21% at the end of 2009.

As of Dec 2021, Firefox has a market share of 3.91%, coming in fourth after Chrome Safari & Microsoft Edge. With a market share of 63.8% & 19.6%, Google Chrome, and Apple Safari have latent advantages. Chrome is the default browser of Android Phones. Safari is the default on iPhones.

But the data gets interesting if we slice the browser market share by mobile and desktop devices. Even on Desktop, Firefox ranks fourth after Safari and Microsoft Edge, but the difference between market share is minimal.

Safari has a 9.54% market share. Edge has a 9.21% market share. Firefox has an 8.48% market share.

For Google & Apple, Chrome & Safari are like walls holding forts. Firefox has no fort to defend, but if recent product developments and market positioning are anything to by, Firefox is a contender to watch out for in the allegedly ongoing third browser war.

FireFox’s Rise, Fall, & Resurgence

When the consumer internet revolution took off in the mid-1990s, Netscape Navigator led the browser market with a share of about 80%.

Navigator’s rise proved the importance of the web. With more people using the browser than ever, the browser became an existential threat to incumbents and a lucrative opportunity for upstarts.

Picture a three-layer pyramid. At the bottom, you have the operating system. The browser inhabits the middle layer. The search engine tenants the top layer.

Ideally, you want to own all three layers of the pyramid. But let’s focus on the browser for now. Settled in the middle, the browser functions as a search engine gatekeeper.

For example, Google wants its search engine to be the default search engine on all browsers. But while Google gets to be the default search engine on Chrome at a minimal price, even factoring development and support costs, it has to pay a hefty fee to other gatekeepers like Safari & Firefox.

Anyway, let’s get back to when Netscape Navigator was leading the browser market. At the time, Microsoft’s Windows had the lion’s share of the OS market, but future applications would run within the browser. Realizing that, Microsoft soon launched the Internet explorer.

On the one hand, Netscape was a small company with limited resources and revenue. The Netscape Navigator browser was free for home and educational use, but business had to purchase a license.

On the other hand, there was Microsoft, a behemoth, with plausibly unlimited resources and revenue.

Microsoft made Internet Explorer free for everybody and bundled it as the default web browser in Windows, gobbling up market share fast. In 2001, Internet Explorer’s browser market share peaked at 96%. Netscape Navigator gradually withered off. The episode was a classic example of the power of defaults.

In 1998, AOL acquired Netscape for $4.2 billion, at a time when it had started losing market share.

In the same year, Netscape had created another organization named Mozilla to develop the Mozilla Application Suite, with dreams of building an everything internet-related bundle. The idea was to package browsing, email, internet forum like newsgroups, and WhatsApp like chat clients, all together in the browser.

By 2003, AOL lost interest in the Mozilla Application Suite, minimizing its involvement with the Mozilla Organization.

To ensure Mozilla would survive alone, AOL helped establish a non-profit entity called Mozilla Foundation.

AOL transferred hardware and intellectual property, employed a three-person team for three months to ensure a smooth transition, and injected $2 million into the newly established Foundation.

In 1998, during the latter half of its glory days, Netscape had open-sourced Netspace Navigators’ code. Netscape later entrusted the Mozilla Foundation with the browser’s code.

The Foundation chose the community-driven model, building Firefox in an open-source environment. When Firefox 1.0 launched in 2004, numerous internal and external factors contributed to its rise.

For starters, Microsoft made minor upgrades in Internet Explorer from 2001 to 2004, none of which were remarkable. The speed of updates was slow, compared to when Microsoft was fighting Netscape Navigator for market share. Internet Explorer had a monopoly, leaving Microsoft with little incentive to keep innovating.

Around the same time, Internet Explorer went through a security crisis, with the US government warning consumers about the security risks associated with the browser.

Firefox’s promised security. The Netscape descendant also came with a user-friendly interface, better performance, and rich features. As if all this wasn’t enough, soon after Firefox’s launch, Microsoft announced future versions of Internet Explorer would require installing the then-newly launched Windows Vista. Technically, Internet Explorer was still free, but Microsoft was indirectly forcing users to buy Vista.

Over the next five years, Firefox’s market share trended upwards (peaking at 32.21%) until Google Chrome launched in 2009. By the end of 2012, Chrome had overtaken both Internet Explorer and Firefox, winning the second browser war.

Even though Chrome won the race in 2012, the second browser war ended in 2017, at least, by some estimates. By Dec 2017, Chrome had a 55.04% market share & Safari had 14.86%. In Sep 2020, the duopoly had a combined market share of 83.27%.

It is essential to understand, though, why Firefox lost its lead in the second browser war. Like in the case of Internet Explorer, a couple of internal and external factors led to Firefox’s decline.

Selena Deckelmann, an engineer who joined Mozilla in 2012 and is now the vice president of Firefox’s Desktop Product Development, said, “I think there was a time where, as an engineering organization, we became complacent.”

In the early days, her job was to analyze the crash reports Firefox generated when things went awry, so she had a front-seat view of the product’s shortcomings.

To add to Firefox’s woes, Android gave Google Chrome & iOS gave Safari the kind of advantage Microsoft had on desktops with Windows. The final nail in Firefox’s coffin was its failure to keep up with computing hardware advances, like the ability to parallelly run operations on multiple CPU and graphics card computing cores.

But since the last few years, things have changed at Firefox. In 2016, Firefox announced it was developing a new browser engine called Quantum. The browser’s core, the web engine, runs all the content you receive as you browse the web.

Firefox released the first Quantum-based version in November 2017. The improved performance garnered raving reviews, but it wasn’t enough to win sizeable converts from Chrome & Safari.

Lately, Firefox has taken an Anti-Chrome/Safari stance, positioning itself as the better privacy-focused alternative.

The privacy angle is astute, considering it is one area where Chrome is unlikely to compete. The crux of Google’s business model is advertising, predicated on collecting as much information about users as possible.

Apple’s Safari has taken steps in the user privacy direction, but the problem with Safari is that you can only access it on Apple Devices.

Anyway, so what privacy-oriented features does Firefox offer?

We’ll get to it, but we need to talk about those ubiquitous web trackers first. Out of the top 6000 websites, 1903 of them have more than ten trackers per page. According to Whotracksme, Google trackers are present on 80% of the web traffic, Facebook’s tracking pixel is installed on 25% of the web. Many of us web perusers don’t realize, but our data is collected, consolidated, traded, and sold without our knowledge.

Firefox comes with Enhanced tracking protection by default. This feature blocks social media trackers, cross-site tracking cookies, crypto miners, and tracking content in private windows on all sites.

The Privacy Protection Dashboard gives users detailed information about the trackers that have been blocked, by type, for the past week. In a blog published on 22nd October, Firefox shared it had blocked cumulatively blocked 1 trillion trackers since 2nd June 2019.

Firefox Monitor helps users find out if their data has ever been compromised, along with details like when it occurred and what data was breached.

Mozilla VPN, like any other VPN, helps people privately surf the web while protecting their identity.

Pocket, first launched as a Firefox extension in 2007, was acquired by Mozilla Corporation in 2017. As of 2015, the ‘Read it Later’ pocket application had 17 million users & 1 billion articles saved.

Firefox Relay is a tool that helps users mask real email addresses from the public eye by creating multiple email aliases instead. Despite sharing email aliases publicly, users still receive emails on their real email addresses. Using Firefox Relay, users can manage all aliases together. If an alias gets spam emails, users can block all messages or delete the alias, right from the Firefox Relay dashboard itself.

Going by the new products Firefox has launched, Firefox seems to be working on expanding beyond its browser-only identity. As of today, the Firefox website reads: “Firefox is more than a browser. It’s a whole family of products designed to keep you safer and smarter online.”

How Does Firefox Make Money

As an organization, Mozilla is uniquely structured, differentiating Firefox from Chrome & Safari.

As we saw earlier, AOL played an essential role in the creation of the Mozilla Foundation. But the Mozilla Foundation was & is to date a non-profit entity. In 2005, Mozilla Foundation created Mozilla Corporation, a for-profit subsidiary.

The foundational arm of Mozilla exists to safeguard the health of the internet. It mobilizes citizens on digital privacy & digital rights issues, backs emerging innovators with funding & mentorship, conducts and publishes research on topics like Trustworthy AI.

The Mozilla corporation serves the Mozilla Foundation, focussing on operating the Mozilla portfolio products and launching new ones.

According to the 2018 Mozilla annual report, the Mozilla Foundation employed around 80 folks, the Mozilla corporation employed over 1000 people. Both Mozilla entities, assisted by thousands of more volunteers, work together under the Mozilla brand.

Firefox is not only Mozilla’s most popular product but also its cash-cow.

Firefox users make more than 100 billion searches every year, meaning being the default search engine on Firefox matters even if you’re Google.

While users can switch to alternative search engines, Firefox comes with different default search engines, depending on the region. Baidu is the default in China. Yandex is the default in Russia, Belarus, Kazakhstan, Ukraine, and Turkey. Google is the default in the Rest of the World.

In 2020, the Mozilla Foundation earned $466 million from its search partnership(most of which was paid by Google ), subscriptions, and advertising revenue. That’s almost the same as in 2019 when Mozilla earned $465 million from these sources. In 2021, the company is expected to generate a revenue of $500 million.

Will Firefox win the third browser war?

At this point, winning back market share from Chrome & Safari seems improbable. But a browser security breach or antitrust ruling intervention can get loads of users to switch to Firefox.

Sure, the privacy-first approach will win Firefox support from a limited number of privacy-conscious techies, but most users never bother changing the default browser settings. Plus, even for a privacy-conscious user, then are a couple of other privacy-focused options like Opera, Vivaldi, etc.

Chrome & Safari are the Goliaths of the browser war. Firefox is David, and it will ensure the browser market doesn’t fall into stagnation like it did after Internet Explorer won the first browser war.

If you liked our piece on Firefox, you might also like our article covering Google’s Business Model.