When Eric Yuan, Zoom’s CEO, decided to go after the video conferencing market in 2011, the market was already flooded with incumbents like Microsoft-owned Skype, Google Hangouts & the then market leader Webex, owned by Cisco.

Eric served as the VP of Engineering at Webex when he decided to venture out independently. So why did he quit Webex, start Zoom & how did he turn Zoom into a leading video conferencing software with almost 50% market share?

There’s no denying that the coronavirus propelled Zoom’s growth in a way nobody could have predicted, not even Eric himself, but Zoom was a successful product even before the whole virus thing happened.

Let’s find out the exciting backstory behind what might look like an overnight success before we delve into Zoom’s’ Business Model.

The Zoom Backstory

Convinced that the internet was the next big thing, Eric decided to migrate to the US from China in the mid-’90s. The first time he applied for a US Visa, his application was rejected. The US customs misunderstood Eric as a part-time contractor because his business card listed him as a consultant. After that incident, the now-skeptical immigration services rejected his Visa 7 more times, but Eric did not give in.

“I told myself, okay, great. I’ll do all I can until you tell me that I can never come here anymore. Otherwise, I’m not going to stop.” He continued reapplying for two years until he was finally accepted on the ninth try.

In 1997, Eric joined Webex as a founding engineer. Operating in the space of real-time video collaboration, the company had half a dozen employees at the time. Webex grew quickly & went public in 2000, riding the exuberance wave of the dot-com bubble. In 2007, Webex was acquired by Cisco for $3.2 billion. By that time, Eric had climbed the ranks to become VP of Engineering.

Eric continued to work on Webex, which was now a part of Cisco, until 2010, when he realized many of Webex’s customers were unhappy with the product. Why were the customers unhappy? The product had not evolved to keep up with the times.

For example, every time users logged into a Webex conference, it took a lot of time to get down to business because the company’s system would first have to identify the version of the product (Android, iPhone, Mac, or PC). If too many people joined the conference, Webex’s system wouldn’t be able to handle the strain, leading to a decline in the audio and video quality. And not just that, Webex also lacked modern features like screen sharing for mobile.

Eric tried to convince his bosses to upgrade the product for a year, but they wouldn’t budge. In 2011, Eric finally decided to leave to give a shot at the video-conferencing business, taking his new product in the direction he wanted Webex to follow. More than 40 engineers followed Eric and left Webex to become a part of his venture.

However, with the market already saturated with products like Skype, Google Hangouts & the then market leader Webex, investors were skeptical of putting money into Eric’s new venture. Fortunately, former Webex CEO Subrah Iyer believed enough in Eric to give him a seed funding of $3 Million.

Two years later, in 2013, Zoom launched its first iteration, raising a $6 Million Series A round at the same time. By May 2013, Zoom’s superior product capabilities helped it reach 1 million participants, connecting more than 400,000 meetings & 3500 businesses.

Zoom managed to get traction because it differentiated itself in many different ways from the existing players. Zoom video conferences were easy to set up and compatible with all devices, including desktop and mobile, via Android and iOS apps. Zoom was able to handle a data loss of up to 40%, so it worked with a weak internet connection. To top it all off, Zoom had a $9.99 per host plan ($14.99 now), which made it cheaper than its competitors.

Zoom kept growing, adding new features along the way. In October 2018, Zoom launched the Zoom App Marketplace, allowing third-party developers to build applications on top of Zoom. The app marketplace, now a common growth lever used by SaaS companies, helped accelerate Zoom’s growth by improving user experience.

In April 2019, Zoom went public at a share price of $36, valuing the company at $9.2 Billion. When Zoom went public, it was already operating at a profit, unlike other tech companies like Uber, Lyft & Pinterest, which went public at around the same time.

In 2020, the pandemic, which forced many businesses to adopt remote work, increased Zoom’s’ popularity in unprecedented fashion overnight. In Dec 2019, 10 million users were participating in daily Zoom meetings. By April 2020, the daily meeting participants had increased to 300 million.

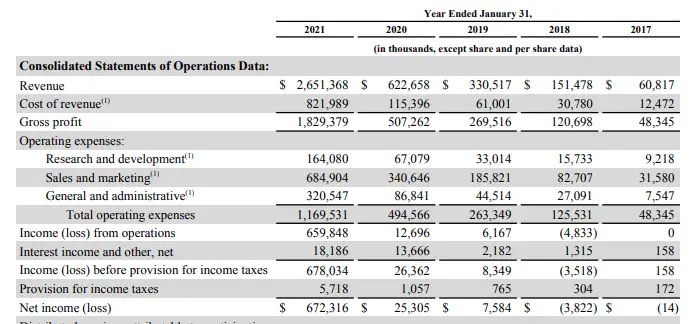

Another indicator of Zoom’s insane success is the company’s growth. In Q2 of 2021 alone, Zoom made more money ($1.021 billion) than it made in the financial year of 2020($622 million). The total revenue earned in 2021 amounted to $2.6 billion.

In July 2021, Zoom announced a $100 million investment fund to stimulate the growth of the ecosystem of Zoom apps, integrations, developer platform, and hardware.

How Zoom Makes Money

Zoom primarily makes money from Zoom Meetings, the core offering it sells using a freemium model. Zoom also generates revenue from 5 subscription-based offerings: Zoom Phone, Zoom Events & Webinar, Zoom Rooms, Zoom United, and Zoom Contact Center. A portion of Zoom’s revenue also comes from the hardware sales and ads shown to free tier users.

Let’s look at each of the subscription revenue sources individually before we move on to discussing company financials.

1. Zoom Meetings

Zoom Meetings allow users to connect through audio & video. It is also the most commonly used and popular service provided by Zoom. Meetings also include Zoom chat, allowing users to share text, images, audio files & content.

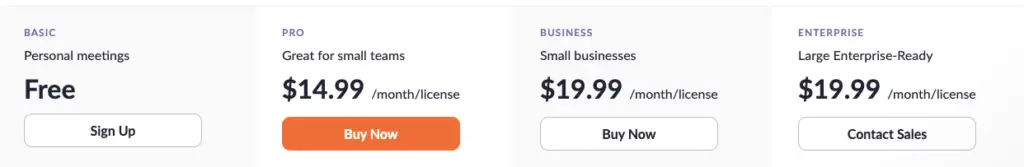

The basic plan is free, but it has restrictions like a 40-minute time limit & 100 participants at most for the group meetings. Zoom offers Pro, Business & Enterprise plans for small teams, small & medium-sized businesses & large enterprises respectively, with features suited as per the size and the needs of the customer.

2. Zoom Rooms

Zoom rooms are conference room systems that allow users ( mostly large organizations ) to have Zoom video meetings seamlessly.

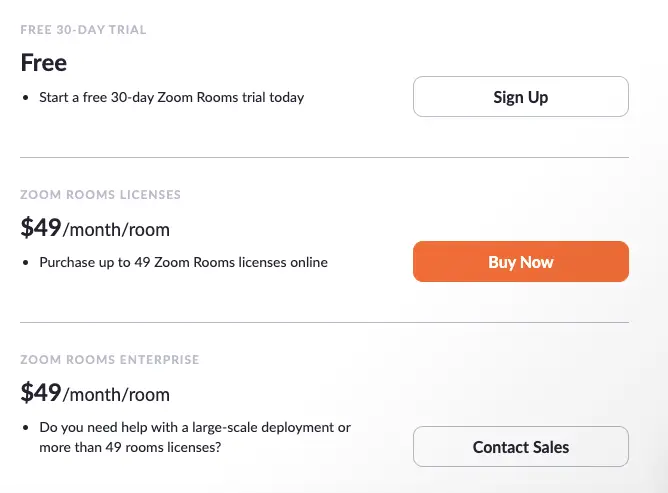

Rooms come with a 30-day free trial. If users wish to continue using Rooms once the trial ends, they can buy a subscription at $49/month per room. The more the number of conference rooms the organizations want to connect through Zoom rooms, the more money they have to shell out. For example, to purchase a plan for ten rooms, organizations would have to shell out $490 per month.

Suppose the customers already have conference rooms set up using Polycom, Cisco, or Lifesize equipment. In that case, they can use the Zoom conference room connector to start Zoom Meetings directly from existing conference room systems.

If they do not have existing conference rooms set up, they can purchase hardware from Zoom’s hardware partners, which include companies like HP, Lenovo & Logitech to name a few. If needed, Zoom also provides customers with installation support for the conference rooms.

3. Zoom Phone

A cloud-based calling solution available as an add-on to the existing Zoom service, Zoom Phone brings traditional phone capabilities directly into the Zoom application, turning Zoom into a complete collaboration product by providing voice, conferencing, messaging, and video services together.

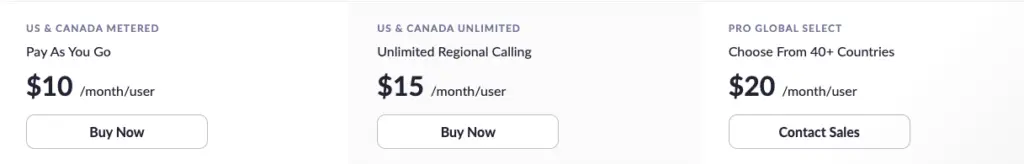

Starting at $10/month per user, it comes with features like auto-attendant, call recording & many more.

4. Zoom Events & Webinars

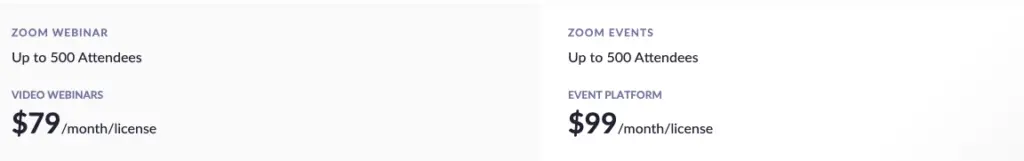

With Zoom Video Webinars, users can host online web conferences. The offering comes at $79/month/license for up to 500 attendees—the $79 base price increases as the number of attendees increases.

While Zoom Webinars are useful for single-session, one-to-many presentations, Zoom events add to the capability of webinars by allowing to connect multiple webinar sessions. Events also come with event management features like branded events hubs, registration and ticketing, and enhanced reporting. The Event offering comes at $99/month/license for up to 500 attendees.

5. Zoom United

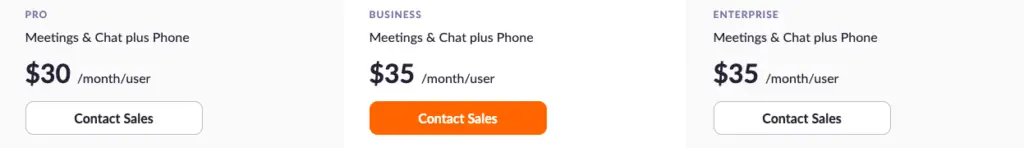

A bundled offering, Zoom United clubs together Zoom Meetings & Zoom Phone under one subscription plan. Users can choose from Pro, Business & Enterprise plans, depending on the features and seats required.

6. Zoom Contact Center

Contact center technologies are mostly optimized for voice. But Zoom Contact center, a new Zoom offering launched in feb 2022, is an omnichannel contact center platform optimized for channels like video, voice and messaging. Zoom does not reveal pricing for the ‘Zoom Contact Center on its website’, revealing it only to companies who reach out to the Zoom.

Zoom Financials

Zoom’s revenue had been doubling every year since 2017, but the 2021 financial year has proven to be a breakout year for the company. In FY 2021, Zoom’s’ revenue grew almost 4x compared to FY 2020, increasing from $622 million in FY 2020 to $2.6 billion in FY 2021.

To measure company performance, Zoom measures two key business metrics — customers with more than 10 employees & customers contributing more than $100,000 of trailing 12 months’ revenue — both of which have been recording positive growth.

As of Jan 2020, Zoom had approximately 81,900 customers having more than 10 employees. By Jan 2021, these customers had grown by almost 5x, with Zoom having around 467,100 of them.

After the pandemic, Zoom’s’ customer cohort with 10 or fewer employees expanded as businesses and individuals adopted Zoom. 36% of Zoom’s’ revenue in the year ended Jan 31st, 2021 came from the 10 or fewer employees cohort, compared to 18% in the previous year.

The ‘‘customers contributing more than $100,000 of trailing 12 months revenue’’ metric represents Zoom’s’ ability to scale with customers & attract larger organizations, acting as a testament to Zoom’s’ growth potential. In the fiscal year Jan 31st, 2021, Zoom had 1644 such customers, more than double the 641 customers it had as of Jan 2020.

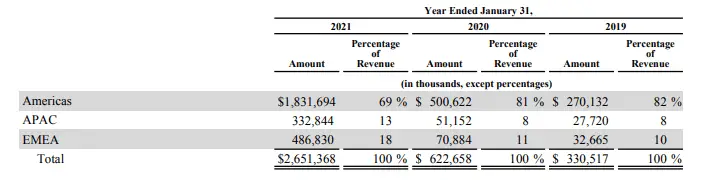

As far as geographic distribution of Zoom’s’ revenue is concerned, 69% of it came from America, 13% from APAC & 18% from EMEA in the year ended Jan 31st, 2021.

In the future, non-American markets can be expected to be one of Zoom’s’ key areas of growth.

Zoom ended FY 2021 with a profit of $672 million, up exorbitantly from the $25 million profit it made in FY 2020.

Read More Case Studies:

Instagram Business Model Case Study

YouTube Business Model Case Study

WhatsApp Business Model Case Study