Companies can generally are categorized into two types: ones that look to make incremental advances in an existing industry to stay relevant in a constantly changing competitive landscape or look to turn entire industries on their head by leveraging innovation.

Lemonade falls into the latter category. And the industry Lemonade is trying to disrupt is insurance. But before we get into how exactly Lemonade is different from legacy insurance players, we need to understand better how the insurance industry works. So, let’s dive into it.

From an insurer’s point of view, insurance might be a vital tool to safeguard for rainy days, but the whole experience of buying and claiming insurance is often excruciatingly painful. Despite getting insurance from a company, people seldom trust the company to have their back. There’s almost always this fear of not reading or misreading an insurance clause that reveals itself when it’s time to file for a claim. And even if the claim were to get approved without misunderstood revelations, the claim filing process and recovery of the insurance money is cumbersome.

The reason why claiming insurance is painful is primarily due to the business model of insurance companies. Insurers make money when their customers lose money. It is in the interest of the insurance companies to not have you claim your insurance amount, which plays, if not a significant but small an undeniable role in the hassles people have to face while claiming insurance.

Lemonade flips the old insurance business model. Unlike legacy insurance companies, Lemonade’s corporate structure consists of a for-profit arm that charges a fixed fee when customers buy the insurance and a not-for-profit arm that settles claims. Here’s how it works.

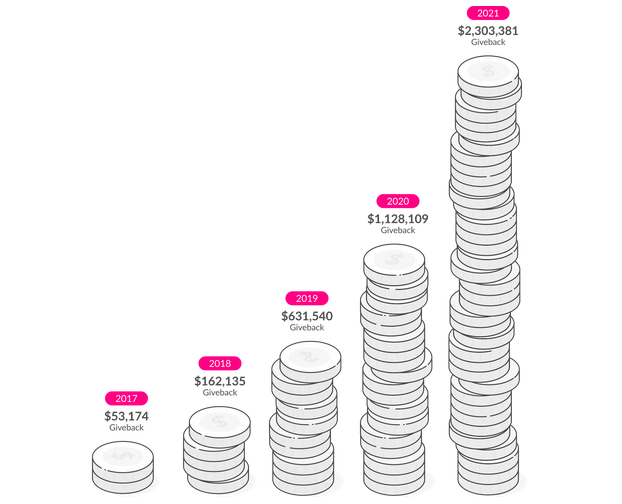

Suppose you buy home insurance from Lemonade. At the outset, Lemonade will take a fixed 25% fee, which the company uses for administrative costs, with the surplus being their profit. The remaining 75% is used to pay claims and reinsurance, and if there’s money left over at year’s end, Lemonade gives it to a charity of the customer’s choice. They don’t keep the money for themselves. So essentially, Lemonade makes money by charging a 25% fee on the insurance amount, treating the remaining 75% like the customer’s money.

What does is it helps build trust between Lemonade and its customers. To top it off, the ‘charity giveback’ feature makes buying insurance fulfilling for customers. Who wouldn’t feel good knowing that a portion of their unclaimed insurance premiums could eventually go to a charity?

The ‘charity giveback’ mechanism has even motivated insurance buyers to return claimed insurances after recovering lost items, a rare achievement in an industry like insurance. And not just that. Lemonade customers are also less likely to commit fraud since they know they’ll also be duping some charity of beneficial funds.

Until now, we’ve seen how Lemonade leverages business model innovation to align its incentives with the customers and create a relationship based on trust. Now, let’s see how Lemonade has orchestrated an enviable customer experience using a modern tech stack.

Instead of solely relying on humans, Lemonade uses AI chatbots for selling insurance and settling claims. Due to this, Lemonade can serve customers faster & reduce human costs relative to legacy insurance companies. In cases where human intervention is required, the AI chatbots have already done so much of the heavy lifting that the work needed to be done by Lemonade employees is way less than it would be without the bots.

As of June 2020, AI Jim, Lemonade’s claim settlement chatbot, settled around one-third of the claims. With time, one can expect the reliance on AI bots to increase and the need for human intervention to decrease.

Because of its innovative business model and superior customer experience, Lemonade has a net promoter score (NPS) of 70 plus. For the uninitiated, NPS measures how likely customers are to recommend a business to a friend.

To contextualize Lemonade’s NPS, a score of 70 plus is usually seen by brands like Apple and Tesla, both of which have a fanatic fan base. The insurance industry, on average, has an NPS of under 20. Because the founding blocks of Lemonade are laid on a digital foundation, it can also collect significantly more data than traditional insurers. Here’s how.

When a person buys insurance from a human broker, they emit several signals about the kind of risk they represent. But all these data points are lost in the ether of the traditional method of human-based insurance selling despite brokers asking approximately 20 to 50 questions. Lemonade AI bot asks customers 13 questions but collects up to 1600 data points.

These data points, which are unavailable to the average insurer, help build proprietary datasets that can predict risk outcomes with an unparalleled level of precision. And all this while, these datasets keep getting richer.

Having enormous data to predict claim risk is powerful, but it still doesn’t capture the whole picture. Lemonade’s systems are fully integrated, so data generated in a customer support interaction can inform the claims process while claims data can be used to gather insights for marketing campaigns.

Lemonade’s innovative business model, superior customer experience, and proprietary data advantage separate it from other insurance players. Now, all this is great, but how do Lemonade’s financials shape up. Let’s find out.

Lemonade’s Financial Performance

As of Q2 2021, Lemonade had 1,206,172 customers, a 48% increase compared to Q2 2020. Premium per customer stood at $246 at the end of Q2 2020, 29% higher from Q2 2020. In Force Premium, obtained by multiplying the number of customers by premium per customer, was 296.8 million in Q2 2020, a 91% increase from Q2 2020.

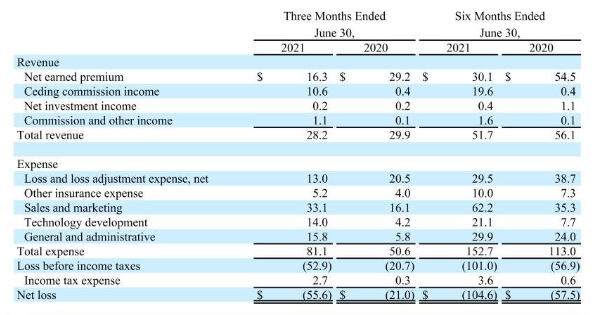

While metrics like customers, the premium per customer, and in-force premium have been trending upwards, the company is not yet profitable. Here’s what Lemonade’s key financial metrics look like:

Will Lemonade ever be able to turn a profit, and if yes, by when?

We’ll have to wait to find out.

![Lemonade Business Model: How Lemonade Makes Money [ 2021 ]](https://whatisthebusinessmodelof.com/wp-content/uploads/2021/08/HowLemonadeMakesMoney.png)