McDonald’s is ubiquitous. No matter which country or major city you go to, you are bound to find a McDonald’s outlet. As of 2020, the company was operating 40,031 outlets worldwide and held the title of ‘The World’s Largest Restaurant Company’. But what if, I told you, McDonald’s is a real estate empire hiding under the guise of a fast-food chain?

In its 2021 Financial Report, the company reported 41.9 billion dollars worth of assets in property & equipment before accounting for depreciation, making it the 6th largest public real estate company in the world even if we were to deduct the more than 3.5 billion dollars worth of equipment from the $41.9 billion figure. McDonald’s real estate assets are the main reason behind its phenomenal and sustained success and what makes it a super interesting business case study.

So how did what seems like a restaurant come to hold 41.9 billion dollars of real estate, and how do these landholdings fit in the overall scheme of McDonald’s business model? To understand all of this, let’s take a trip down the road of history to travel back to the early days of McDonald’s and trace its journey from functioning as a regular restaurant chain to becoming a real estate empire hiding under the guise of a fast-food front.

Ray Kroc, the man responsible for scaling McDonald’s across the United States, was just another milkshake machine salesman in his prior gig. Even though Wikipedia lists him as one of the founders of McDonald’s, neither did he come up with the idea, nor was he even a part of the first and the original McDonald’s outlet.

McDonald’s, named eponymously, was the brainchild of two brothers: Richard & Maurice McDonald’s. Ray met the McDonald’s brothers after they ordered eight mixers at one go, a huge number considering the mixers had multiple spindles. In those days, it was rare to get such a large mixer order, making Ray curious about how a small restaurant could create such high demand.

When Ray understood the concept of McDonald’s & saw its operations, he was blown away. Never in his entire career of selling mixers to restaurants had he seen such a remarkably effective restaurant. But what made McDonald’s, which seems like just another restaurant today, special back then?

In the early 20th century, once cars became common in the US, drive-through restaurants also became common. However, the problem with these restaurants was that customers would have to wait for a long to get their food. Disposable plates and forks were also not popular back then; meaning customers had to eat in their car with regular plates & forks and then wait to return the dishes once done. The whole experience was as time-consuming as it would be if customers were to visit a typical restaurant.

McDonald’s brothers came up with a solution for both of these problems. Using a new assembly line method that increased efficiency, the two assembled the food fast, delivering tons of burgers every few minutes. They ditched silverware favouring the self-disposable wrapper, a common occurrence today but a novelty in those days. Self-service eliminated the need for waiters & waitresses. A simplified menu included only limited items: hamburgers, potato chips (later replaced by french fries), drinks, and pie. Working together with delicious hamburgers priced at an affordable 15-cent rate, these innovative and creative techniques led to a highly efficient restaurant operation, which in totality, impressed Ray like never before.

When Ray suggested expanding McDonald’s across America using the franchising model, the McDonald brothers had already sold more than 20 franchises and operated eight restaurants independently. But they weren’t too keen on expanding nationally, so Ray offered to take up the primary expansion responsibility, and the two parties struck a deal.

In those early days, McDonald’s franchised outlets using the regular model — franchises would pay a royalty fee to use McDonald’s brand name. Initially, 1.9% of the franchise profits went to the McDonald’s corporation, 0.5% of which went to the McDonald brothers, while Ray used the remaining 1.4% to drive further expansion.

In 1956, Ray met a man named Harry J. Sonneborn, who gave him a simple idea that would help him accelerate the growth of McDonald’s across the country: Own the real estate where future franchises would be built.

In this new arrangement, which is now popularly known as the Sonneborn model, McDonald’s would buy the land franchises were to run their outlet on at long-term fixed interest rates and lease it to the franchise owner at a markup. The genius of the Sonneburn financial model was that McDonald’s would earn royalty fees from franchisees and collect rent, as well as keep adding real estate assets to its portfolio. After McDonald’s switched to the Sonneborn model in 1958, the company added 68 locations in a year.

While, on the one hand, McDonald’s was expanding across America, on the other hand, disagreements between the McDonald brothers and Ray over the company’s vision began to intensify. In 1961, Ray went to the McDonald brothers, the actual founders, and asked them how much money it would take to leave the business to him entirely. The brother demanded $2.7 million, and Ray bought them out. By 1963, Ray and Sonneborn were operating 500+ locations across America. In 1967, McDonald’s started its international expansion, opening outlets in Canada & Puerto Rico. As of 2021, the company operates in 119 countries.

At the time of writing, here’s how McDonald’s makes money from its franchises:

— One-time franchise fee of $45,000

— 3-month base rent of $313,000 or percentage rent of 31.75% of sales

— 4% commission on sales

— Advertising and promotion fee ( Not less than 4% of gross sales )

On average, franchisees have to spend around $1.5 to $2.5 million in total to start an outlet. According to Mashed.com, the average McDonald’s location makes $2.7 million in sales and around $150,000 in profit. Why would someone agree to invest in a franchising scheme where profit is just 5.5% of revenue, you would think? Well, it is because the odds of success are significantly higher. McDonald’s is a well-known brand, so foot traffic is more likely than in the case of developing a new restaurant concept from scratch.

As of year-end 2020, 93.16% of McDonald’s ( 37,295 out of the total 40,031 ) were franchised, signifying the strength of the franchising model for both McDonald’s and franchises. Out of the total $23.2 billion McDonald’s made in 2021, $9.7 billion came from 7% of the company-owned stores, and $13 billion came from the 93% franchise-operated stories.

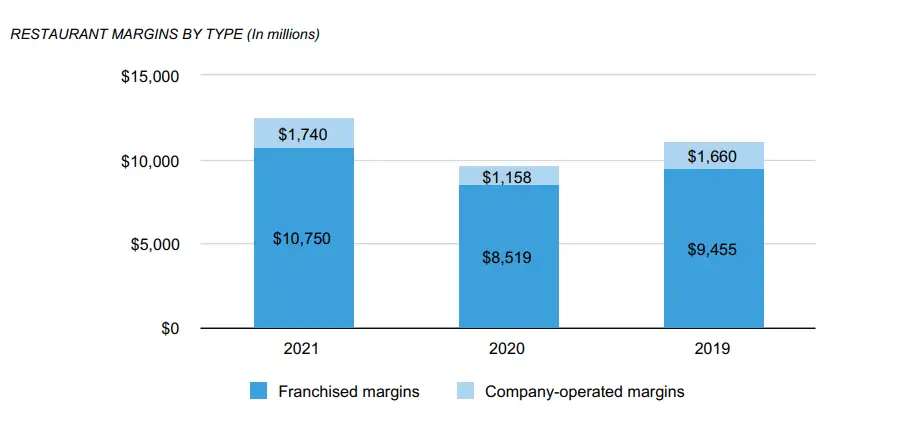

If we look at revenue proportionally to the percentage of stores, having more company-operated stores would increase McDonald’s revenue by an order of magnitude. Why is it, then, that McDonald’s has been doing the exact opposite over the years; increasing the number of franchise-owned stores and decreasing the number of company-owned stores? Well, it is because the profit margin numbers tell a very different story. Even though 7% of company-operated stores made a revenue of $9.7 billion in 2021, they made a profit of only $1.7 billion because expenses stood at $8 billion. On the other hand, while 93% of the franchise-operated stores made a revenue of $13 billion, profit stood at $10.7 billion because it cost McDonald’s only $2.3 million to run these outlets.

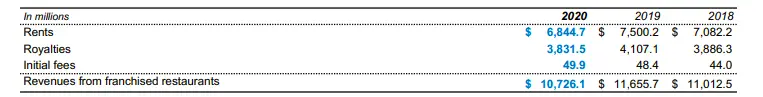

If we break up McDonald’s franchise-operated revenue further, we see that rent contributes way more to the bottom line than royalties, proving the brilliance of McDonald’s real estate model. Out of the $10.7 billion McDonald’s collected in fees from restaurants in 2020, $6.89 billion came from rent, and $3.8 billion came from franchise royalties.

To sum it all up, here’s how McDonald’s real estate model works: While McDonald’s is, obviously, a franchise-based restaurant giant, the rent it collects from franchises is more than the amount it gets in franchise royalties. McDonald’s also buys the land and building at most of its locations, adding real estate assets that keep growing in value to its portfolio.

The real estate-based strategy integrated with a strong brand loved by billions worldwide has helped fuel the growth that has made McDonald’s a member of an elite group of stocks named Dividend Aristocrats. For the uninitiated, the Dividend Aristocrats consist of a group of companies in the S&P 500 Index, with 25+ consecutive years of dividend increases. In the case of McDonald’s, the company paid its first dividend in 1976. McDonald’s dividend has increased every year since then, for more than four consecutive decades.

If you like reading this piece, you might also enjoy reading my ‘Tesla Business Model Case Study‘.