Most of us know Netflix as the online streaming company that makes money by selling a monthly subscription pack to its customers to access the content available on its platform. But that’s not how Netflix originally started.

The Netflix of today looks nothing like the Netflix of day one. In its 24 years of existence, Netflix’s business model underwent four significant strategic shifts. In this piece, I will run you through all the four business model changes Netflix went through and explain Netflix’s current business model.

Why was Netflix started?

Before he started Netflix, Reed Hastings, Netflix CEO, was just another customer of a company named Blockbuster. Blockbuster was a leading America-based movie and video game rental shop during those days. The story goes that the idea for Netflix occurred to Reed Hasting in 1997 after he was slapped with a $40 late fee for the Apollo 13 movie by Blockbuster.

In an interview with Forbes magazine in 2009, Reed Hastings said,

“I remember the fee because I was embarrassed about it. That was back in the VHS days, and it got me thinking that there’s a big market out there.

So I started to investigate the idea of how to create a movie-rental business by mail. I didn’t know about DVDs, and then a friend of mine told me they were coming.

I ran out to Tower Records in Santa Cruz, Calif., and mailed CDs to myself, just a disc in an envelope. It was a long 24 hours until the mail arrived back at my house, and I ripped them open and they were all in great shape. That was the big excitement point.“

Even though Netflix’s other co-founder March Randolph has gone on record to say that Reed’s version of the founding story isn’t accurate, Reed’s founding story is still helpful in understanding the general idea behind the company’s founding. The then incumbent Blockbuster operated on a retail shop pay-per-rental model.

Netflix launched in 1998 as an online movie rental service with the same traditional pay-per rental model. Netflix even charged the same late fees, which apparently, motivated Reed Hastings to get into the business, just like Blockbuster.

The only advantage Netflix had over BlockBuster at that time was better distribution. Instead of the customers going to a BlockBuster store to fetch a DVD, the DVD essentially came to them at their house.

But the DVD mailing model had two major disadvantages:

- While it eliminated the hassle of visiting a Blockbuster store for the customer, it took between one to four days for the DVDs to reach them, which was a win-lose scenario for the customer.

- To break even on the cost of purchasing a DVD to rent, Netflix had to generate 15-20 rentals for each DVD. And even though people tried the service, the number of repeat rentals was low since people were inclined to rent out the latest releases.

The company innovated its way out of both problems by adopting a subscription-based model back in 1998 when it wasn’t as ubiquitous as it has become today.

The Shift to a Subscription-Based Model

The subscription-based model acted as a forcing function for the customers to continue using Netflix’s DVD rental service, improving second-time movie rentals.

Netflix even implemented a queue, giving users a method to select which movies they would like to watch next to expedite the process of users receiving another DVD once they had returned their original one.

This move enabled Netflix to drop late fees because the idea of getting another DVD in exchange for their current one acted as a motivation for the customers to return their DVDs to Netflix on time.

On the one hand, there was Blockbuster, which was still charging late fees, and on the other, there was Netflix, which had dropped it. Late fees contributed massively to Blockbuster’s revenue, and it wasn’t until 2004 that the company finally decided to let go of it.

To improve user engagement and utilize their DVD catalog efficiently, Netflix also developed a movie recommendation system named Cinematch. The system allowed Netflix to sell more movies that were not the latest releases, thereby uniformly distributing the sales of their DVD catalog.

In 2002, Netflix went public at a share price of $15 and made a profit for the first time in the fiscal year 2003, reporting a revenue of $272 million & a $6.5 million profit. By 2005, the company was shipping 1 million DVDs every day.

Move to Online Streaming

Even though Netflix was at the pinnacle of its DVD rental business, the company planned to get into online streaming.

“We never spent one minute trying to save the DVD business,” said Ted Sarandos, Netflix’s chief content officer since 2000.

They had only been waiting for broadband speed and streaming technology built into consumer devices to hit a critical mass before making a move. And when the timing was right, in 2007, the company launched its online streaming service in the United States with a collection of licensed movies and shows from Hollywood studios.

While DVD sales fell from 2006 to 2011, Netflix’s business grew.

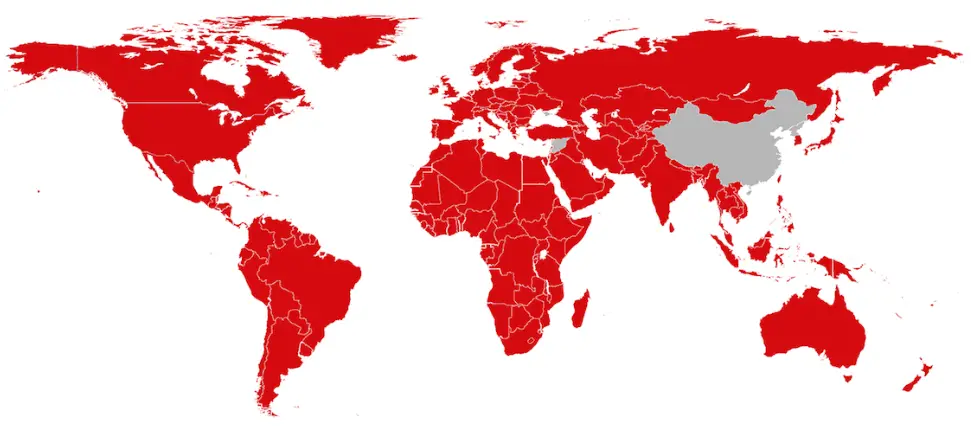

The company first began its international expansion in 2010 with its launch in Canada. Today, Netflix is available in over 190 countries, excluding China, North Korea, Russia, Crimea & Syria.

Note: The red territory represents the countries Netflix is present in, while the grey territory represents its absent territories.

Producing Original Content.

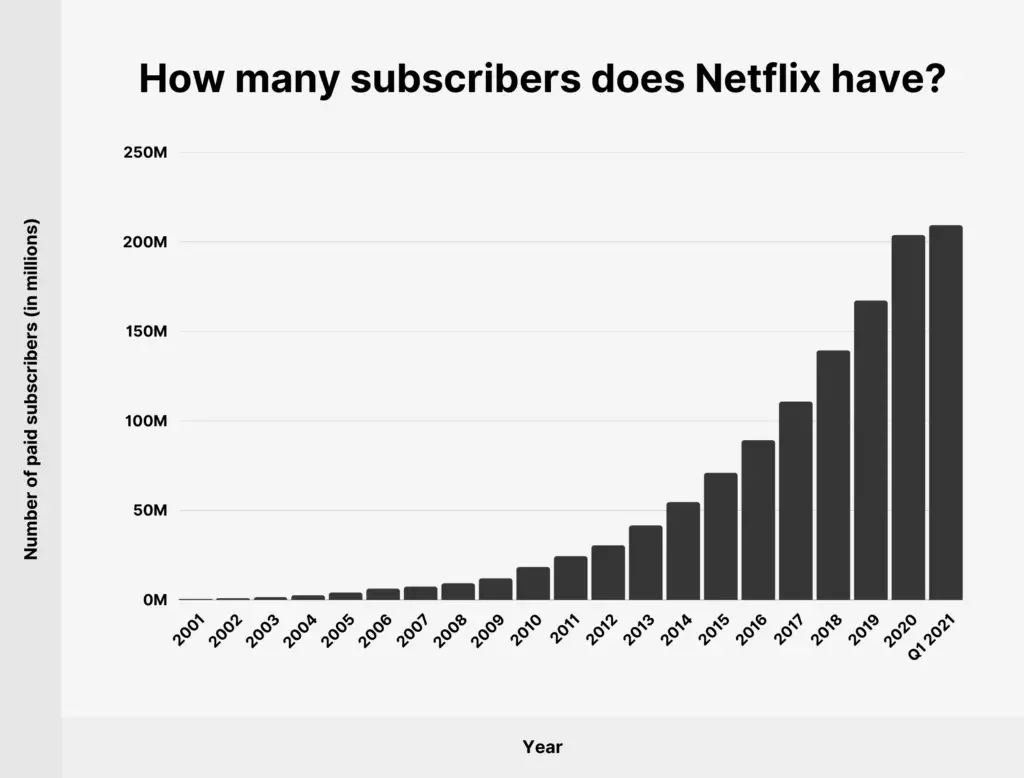

From 2007 to 2013, until Netflix’s next big strategic move, subscribers grew from around 7 million to 33 million.

Seeing Netflix’s growth, Hollywood movies and series production houses started demanding more money for licensing their content, pushing Netflix to get into original content to secure their future.

In 2013, Ted Sorandos made another interesting comment regarding the shift in Netflix’s strategy.

He said, “The goal is to become HBO faster than HBO can become us.”

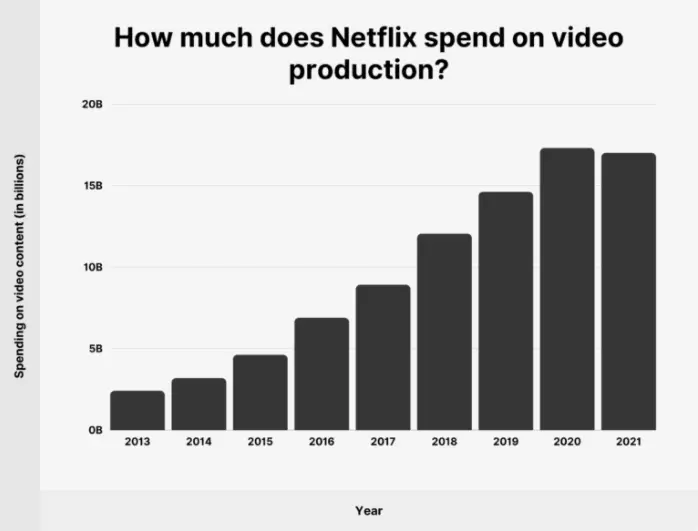

From 2014 to July 2018, Netflix spent over $30 billion on original content.

Netflix’s spending on producing original content peaked in 2020.

Netflix Business Model

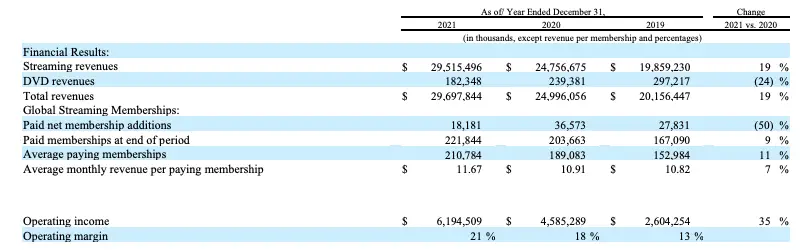

Netflix makes money from two different business segments. Its primary source of revenue is subscription-based streaming, which it offers under different pricing models basis the country. Secondarily, Netflix also generates revenue by selling DVDs. In 2021, Netflix earned $29.8 billion from streaming and $182 thousand from selling DVDs.

As is evident from the segment-wise financial breakdown, the contribution of the DVD segment has been declining year-on-year as more people switch to streaming. Netflix has been running the DVD segment, despite minuscule revenue contribution from it because it does not want to upset DVD customers and wants the segment to die a natural death.

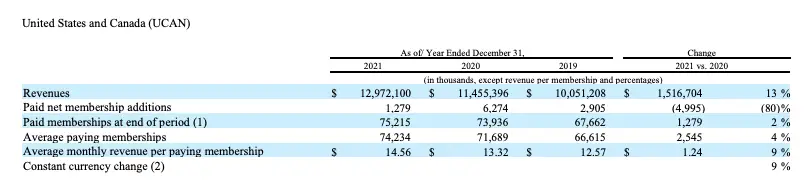

From 2020 to 2021, Netflix’s revenue increased by 19%. The increase in revenue was driven by a 11% growth in average paying memberships and a 7% increase in average monthly revenue per paying membership.

Netflix’s ability to increase its revenue is dependent on two different strategies — increase in subscribers and increase in the subscription cost. However, subscription costs can only be increased gradually and to a certain extent. So, the ability of Netflix to succeed is mainly dependent on growing its number of subscribers.

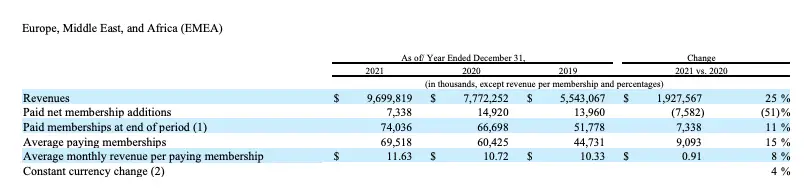

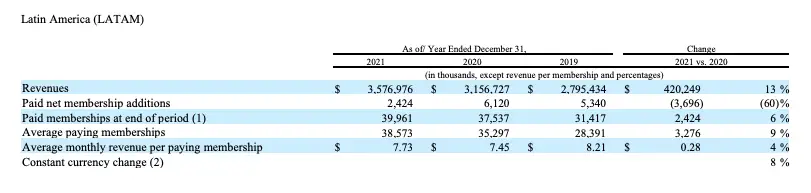

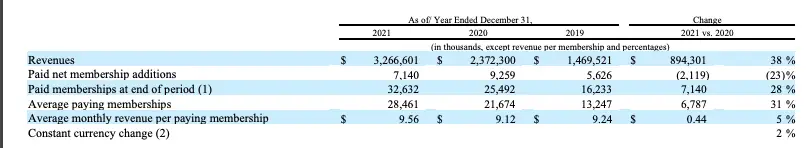

In terms of market-wise distribution, Netflix generates most of its streaming revenue from US & Canada, followed by Europe, the Middle East & Africa, followed by Latin America, followed by APAC.

US & Canada Streaming Revenue

Europe, the Middle East & Africa Streaming Revenue

Latin America Streaming Revenue

APAC Streaming Revenue

In the coming years, Netflix’s revenue growth can be expected to be higher in markets like APAC, Middle East & Africa.

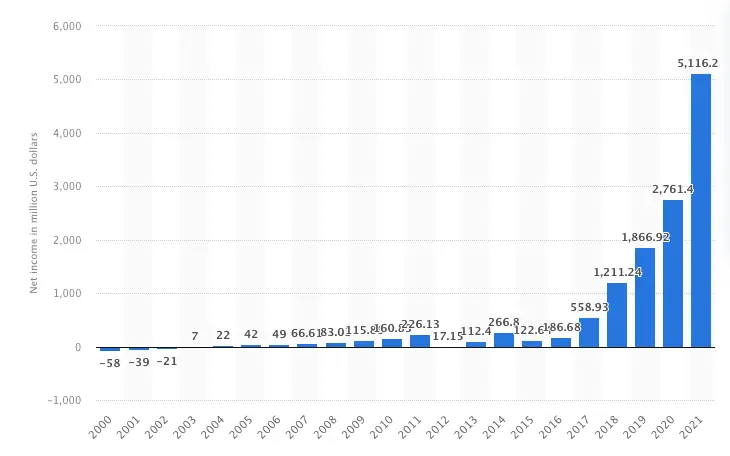

Netflix is a profitable company. In 2020, Netflix generated $5.1 billion in net income, up from the $2.7 billion it made in 2019.

However, the company has negative cash flows due to its massive spending on buying content licenses and producing original content.

How much more room for growth does Netflix have?

As of 2021, Netflix was present in over 200 million-plus households worldwide.

To put the numbers into context, there were 1.7 billion households with TV in 2019 alone, which is expected to grow even more in the coming years.

Even if we were to exclude the TV households of the countries Netflix is absent, the company is yet to capture a huge portion of the total addressable market.

But the streaming landscape continues to get fiercely competitive day by day with players like Disney & Apple launching their own streaming services, to add to Netflix’s more obvious and older competitors like Amazon Video, Hulu, HBO, and YouTube.

Netflix’s subscribers growth also has been decreasing, so only time will tell if the company can compete with upstarts successfully, or else it might end up getting acquired by a biggie.

Read More Case Studies

Shopify Business Model Case Study

Tesla Business Model Case Study

Pinterest Business Model Case Study