In his book Zero to One, Peter Theil, previously co-founder of Paypal and venture capitalist, argued that the inherently hyper-competitive nature of restaurants makes them a mediocre business.

Here’s what he wrote in Zero to One:

“Suppose you want to start a restaurant that serves British food in Palo Alto. “No one else is doing it,” you might reason. “We’ll own the entire market.”

But that’s only true if the relevant market is the market for British food specifically. What if the actual market is the Palo Alto restaurant market in general? And what if all the restaurants in nearby towns are part of the relevant market as well?

These are hard questions, but the bigger problem is that you have an incentive not to ask them at all. When you hear that most new restaurants fail within one or two years, your instinct will be to come up with a story about how yours is different.

You’ll spend time trying to convince people that you are exceptional instead of seriously considering whether that’s true. It would be better to pause and consider whether there are people in Palo Alto who would rather eat British food above all else. It’s very possible they don’t exist.

In 2001, my co-workers at PayPal and I would often get lunch on Castro Street in Mountain View. We had our pick of restaurants, starting with obvious categories like Indian, sushi, and burgers. There were more options once we settled on a type: North Indian or South Indian, cheaper or fancier, and so on.

In contrast to the competitive local restaurant market, PayPal was at that time the only email-based payments company in the world. We employed fewer people than the restaurants on Castro Street did, but our business was much more valuable than all of those restaurants combined.

Starting a new South Indian restaurant is a really hard way to make money. If you lose sight of competitive reality and focus on trivial differentiating factors—maybe you think your naan is superior because of your great-grandmother’s recipe—your business is unlikely to survive.”

But Peter Theil’s book came out in Sep 2014, around the same time when food delivery facilitated by the internet was beginning to take off.

While food delivery itself did not negate Peter Theil’s argument, the new opportunity it unlocked for restaurants put a sizeable dent in Peter’s argument by changing the entire economics of opening, running and scaling up a restaurant.

So what was this new opportunity?

Let’s find out through the story of Rebel Foods ( Formerly Faasos ) because they seized this new opportunity unlike any competitor worldwide to become the world’s largest internet restaurant company, building more than 1000 restaurants in 24 months along the way.

The seeds for Faasos were originally sown way back in 2003. And like many other entrepreneurial stories, the turn of events that transpired post-launch were nowhere near ideal.

Somehow, Jaydeep Barman & Kallol Banerjee, the two founders managed to add four more branches by 2006, but Jaydeep jokingly remembers that back then he was the most broke he had ever been.

In the midst of all this, he went to France to pursue his second MBA. His first one was from IIM Lucknow. His partner Banerjee also followed him a year later.

Post-MBA, the two founders did what most other entrepreneurs would like to skip if given a choice: one worked as a consultant at Mckinsey London and the other sold enterprise software at Bosch Singapore.

During those stints, the founders had left Faasos to run on autopilot with two other people managing it.

It wasn’t until 2010 that the two founders Jaydeep & Kallol become extremely serious about this project called Faasos. And once that happened, both of them quit their jobs and returned to India.

The first big breakthrough came when they raised $5 million from Sequoia Capital in October 2011. In the next two years, Faasos expanded at lightning-fast speed, opening 75 Quick service restaurants (QSRs) across India’s major cities.

Back then, a typical Faasos joint just had a small standing area with a table or two, and a kitchen to cook food, of course. But as Faasos grew, the challenges of building a retail network started coming to light.

One of the biggest challenges was location failure — a challenge that almost every multiple chain restaurant, or even a single outlet restaurant has to go through.

If a good location failed, the high rents paid for acquiring the location worsened the failure. Even when a location succeeded, balancing dine-in and delivery customers from the same store was a challenge.

Luckily, during that time, around 2013, another business model was starting to take shape — food delivery facilitated by the internet.

Like any other diligent founder, Jaydeep & Kallol were both following this emerging food tech trend closely. They ensured Faasos became one of the early adopters of online ordering platforms and their prompt actions gave a big boost to their existing business.

The big turning point for Faasos came when they found out that their web and phone delivery business was growing independently of the stores — 70% of the customers had never stepped in a Faasos outlet.

Once the founders saw that data, they decided to shut down the quick service outlets and lease low-rent spaces for kitchens instead to transition from being a quick-service restaurant to a kitchen with only online delivery.

The shift changed the entire economics of the business: The rent-to-sales ratio dropped from 15% to 4% in the next 2 years.

And more importantly, Faasos no longer had to worry about finding great locations & location fatigue — two problems that had previously hampered the scale-up operation.

But breaking away from the shackles of offline presence was just the first step. Step two was the realization that they were no longer restricted by customer perceptions that exist in running an offline restaurant.

So, the general rule of restaurants is that they are built around and specialize in a specific cuisine.

You go to McDonald’s when you feel like having a burger. You go to Pizza Hut when you want to devour Pizza. The same can be said about local food eateries, which are also more often than not known for one thing or the other.

While specialization is a great strategy for offline restaurants, it comes at the cost of food fatigue. People don’t like to eat in or order from the same restaurant, week in and week out.

But if you’re an online-only restaurant, then the possibilities begin to change. Since the cost of launching a new restaurant brand online is lower than the cost of launching one offline, the cost of failure is lesser too. And that’s where Faasos cashed in.

In 2016, they launched a brand called Behrouz Biryani, using the same Faasos kitchen & staff to fulfill orders.

The new Biryani concept was piloted not in all, but a few Faasos kitchens, and only consumers in and around those kitchens were targeted via app & 3rd party platforms.

This way, they could even get customer feedback at a relatively low cost and in less time, which in turn led to efficient menu iterations.

Soon, Behrouz Biryani went national and was delivering more than 200,000 Biryani’s a month, all of this within a year. 18 months into launch, Behrouz had skyrocketed to become a $12 million business.

Jaydeep & Kallol had now built another online restaurant brand with minimal investment in marketing & Capex, reaching a different set of customers, expanding the market opportunity even further by pivoting away from a single brand, single kitchen model to a multi-brand, multi-purpose cloud kitchen model.

But the founders didn’t rest on their laurels. The three biggest constraints of running an offline restaurant: location failure, food fatigue & the financial risk of scaling up no longer existed.

Banking on the success of Behrouz Biryani, they launched a pizza brand called oven story and another brand called Firangi Banke — one that specializes in making oven-baked dishes like lasagne ( lazania ), Quesadillas ( kesadia ), Mac, etc, but with an Indian twist.

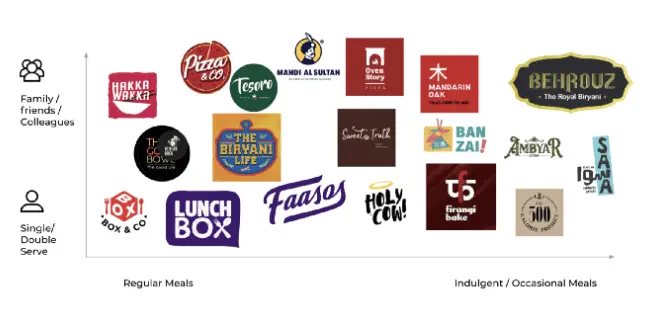

By October 2018, they had launched at least 20 such brands, scaling up 7 pan India. No brand was scaled up until and unless it achieved product-market fit.

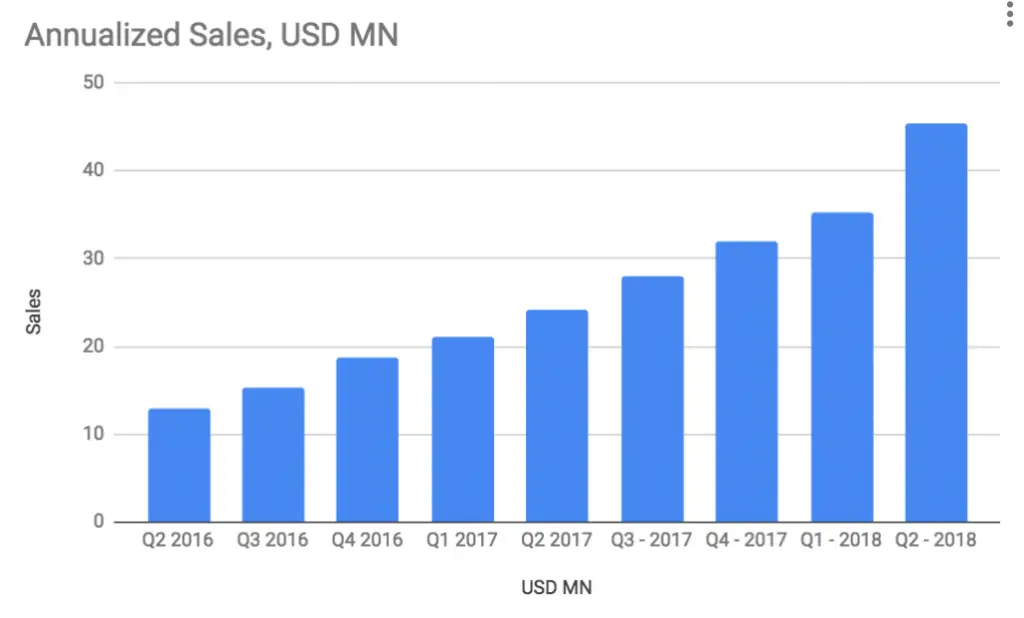

The revenue grew by 4X in the previous 24 months since Aug 2018, while the kitchen footprint grew only by 20%. Every new kitchen launched became profitable within three months and the investment of building them would get recovered in 12 months.

Once the individual food brands began to succeed, the founders changed the name of the company. While “Faasos” remained as the brand name for their “wraps & meals” restaurant, “Rebel Foods” became the parent brand for all current and future online restaurant brands.

For the founders, the key insight that came out after building & scaling multiple online restaurant brands was that they were still scratching the surface in terms of what could be done.

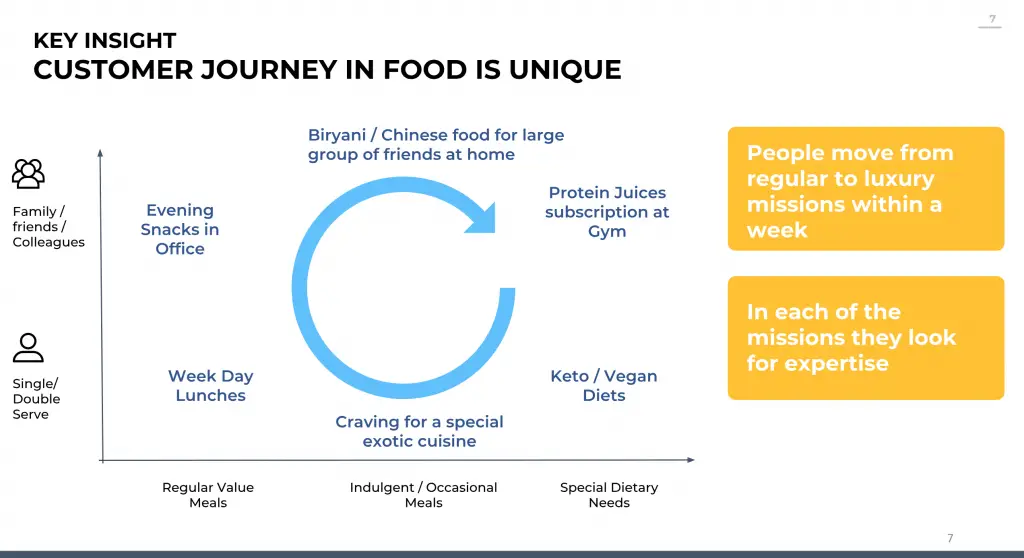

Think about it. Food is a unique category in the sense that it sees a consumer transition from the lower end of the spectrum to the higher end of the spectrum within a matter of weeks.

Someone who has a Rs 20 Vada Pav during the weekday might go out to a fine dining restaurant on the weekend.

On the other hand, the transition from economical to luxury is longer in categories like cars, clothes & mobile phones.

You don’t go from owning a Maruti to Mercedes or from buying clothes from local stores to wearing designer clothes in a matter of days.

Food is also unique in the sense that people prefer specialists over generalists, as we discussed earlier.

Marry these two insights and you can keep building online restaurant brands touching individual food needs & with time, the diverse basket of offerings can touch a customer’s food journey several times during a day, a month, or a year.

In the words of Jaydeep Barman, it’s like building a Unilever that touches a customer’s daily life in a multitude of instances.

And Rebel Foods already had the operational advantage it has gained from launching and scaling multiple online restaurant brands.

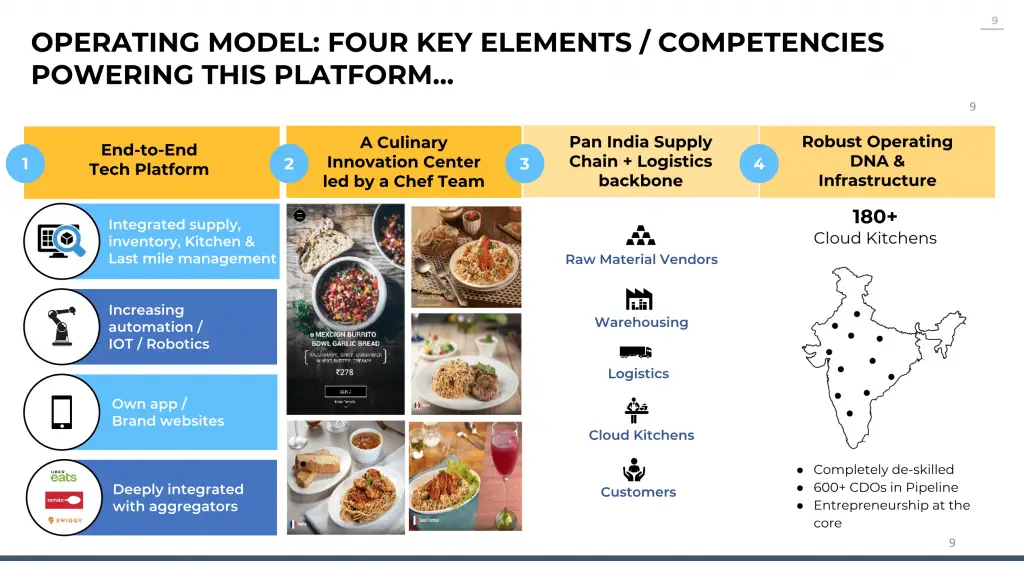

It boasted of an end-to-end tech platform, a culinary innovation center lead by a chef team, a pan India logistics chain, and a robust operating DNA & infrastructure.

Around the end of 2018, the Rebel Foods team thought that it they could build and scale up new food brands across varying customer food profiles, they could also build food brands in countries other than India.

The Middle East and SouthEast Asia were chosen as pilot destinations for international expansion. From mid 2019 to end of 2020, Rebel launched 30 kitchens in Dubai & Jakarta, building local food brands as well as exporting their Indian brands like Behrouz, Faasos, Ovenstory, Sweet Truth, and Mandarin Oak.

In the second half of 2020, Rebel also expanded to London with five established brands and a localized healthy offering. Going forward, new brands launched in international markets can also travel globally & make their way back to India.

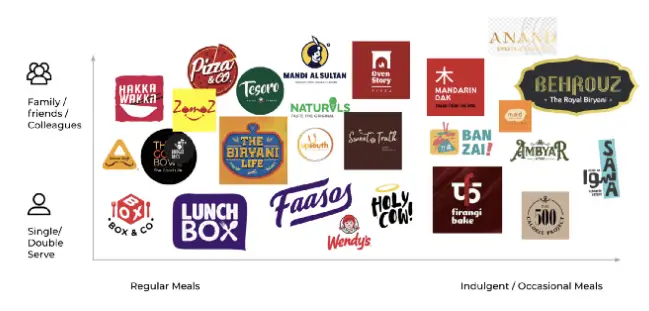

As of Dec 2020, Rebel Foods brand portfolio looked like this:

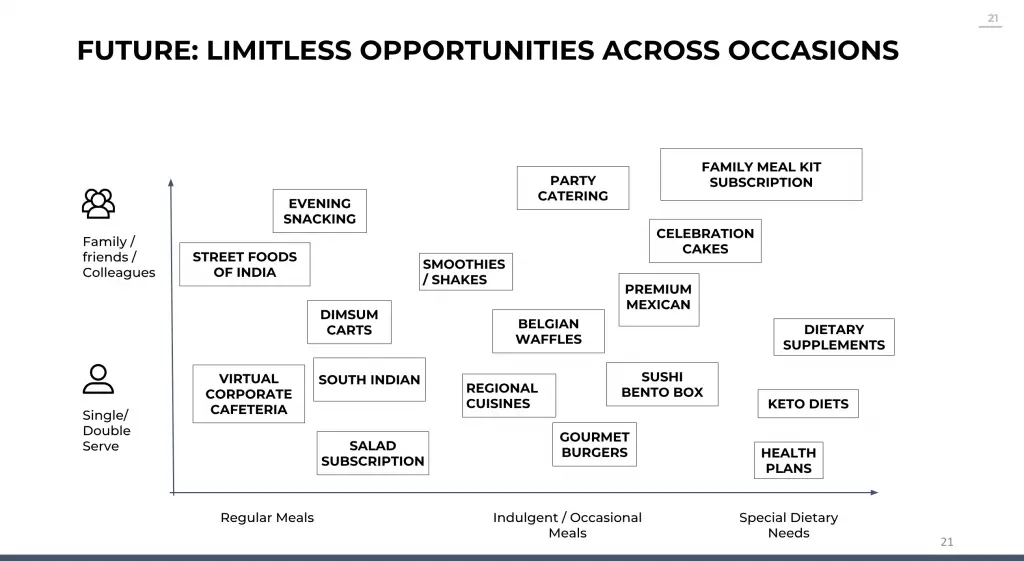

Now, even though Jaydeep & Kallol had built a India-wide footprint for restaurant brands in some of the largest categories & were expanding expanded internationally, the future opportunities were still limitless which made the founders realize that their operational platform, learnings & expertise could be put to better use if shared with others, rather than keeping it to themselves.

And that’s how the seeds for Rebel Launcher were sown. In addition to building their own brands, Rebel Foods has opened up its platform under the Rebel Launcher program for enthusiastic food entrepreneurs looking to launch new food brands.

Under the Rebel Launcher program, entrepreneurs not only got funding from Rebel Foods but they were also given access to Rebel Food’s kitchens, manpower, technology, culinary innovation, and supply chain to build, launch and scale their vision. You can think of this arrangement as the kind of arrangement s startup undergoes with a startup accelerator.

By Dec 2020, Slay Coffee, an emerging coffee brand from Bangalore had already successfully scaled to 100+ Rebel Food kitchens across five cities leveraging Rebel’s operational expertise.

While Rebel Foods had only opened up its platform for new entrepreneurs, it also started getting inbound inquiries from well-established brands wanting to leverage Rebel Foods’ kitchen network and operational expertise especially during the pandemic.

Identifying the huge opportunity in collaborating with well established brands, Rebel Foods started onboarding them as well on the Rebel Launcher program. Rebel partners with established brands under two different types of agreements: platform service and licensing.

Under the platform service model, established brands use Rebel’s platform(Kitchens and operational expertise) to expand in regions they aren’t present in, including new locations in existing cities, new cities and even internationally. Some of these brands that have partnered with Rebel in the platform service model include Naturals Ice Cream, Mad Over Donuts, UpSouth, Zomoz and Anand Sweets.

Under the licensing model, Rebel obtains the licensing rights of an established brand and scales it themselves. A testament of the success of this model is that after a five month pilot in 2020, Rebel secured an exclusive cloud-kitchen license in India for Wendy’s, the world’s third-largest burger brand.

As of Dec 2020, here is what Rebel’s portfolio looked like, including internally grown and externally onboarded brands:

Between 2016 to 2020, Rebel’s business has grown by 9x. Today, it is the world’s largest restaurant company with 4000+ virtual restaurants, built on 550+ kitchens in 70 cities across ten countries. The future looks immensely bright for Rebel. Not only can it launch new brands expand its existing network of restaurants, it can also help outside restaurant brands, including new entrepreneurs and established brands, scale and grow rapidly using its unique model.

The only thorn in this story full of roses is that Rebel is yet to turn profitable because it is currently in blitzscaling mode. In FY21, Rebel Foods made a revenue of Rs 405 crores, but losses stood at Rs 364.12 crores.

Will Rebel compensate for the losses it is making in the growth phase and turn profitable? Only time will tell.

Read More Case Studies

Tesla Business Model Case Study

WhatsApp Business Model Case Study

Google Business Model Case Study