The advent of the internet and the subsequent rise of tech companies, as it did with all other industries, changed the music industry. Amazon changed the way we shop. Netflix changed the way we consume entertainment. Uber changed the way we book cabs. Similar to Amazon, Netflix & Uber; Spotify changed the way we listen to music.

In the process of disrupting the respective industries they chose to target, each of these companies — Amazon, Netflix, Uber & Spotify — altered the behavioral design of the society and upended the economics of the industry.

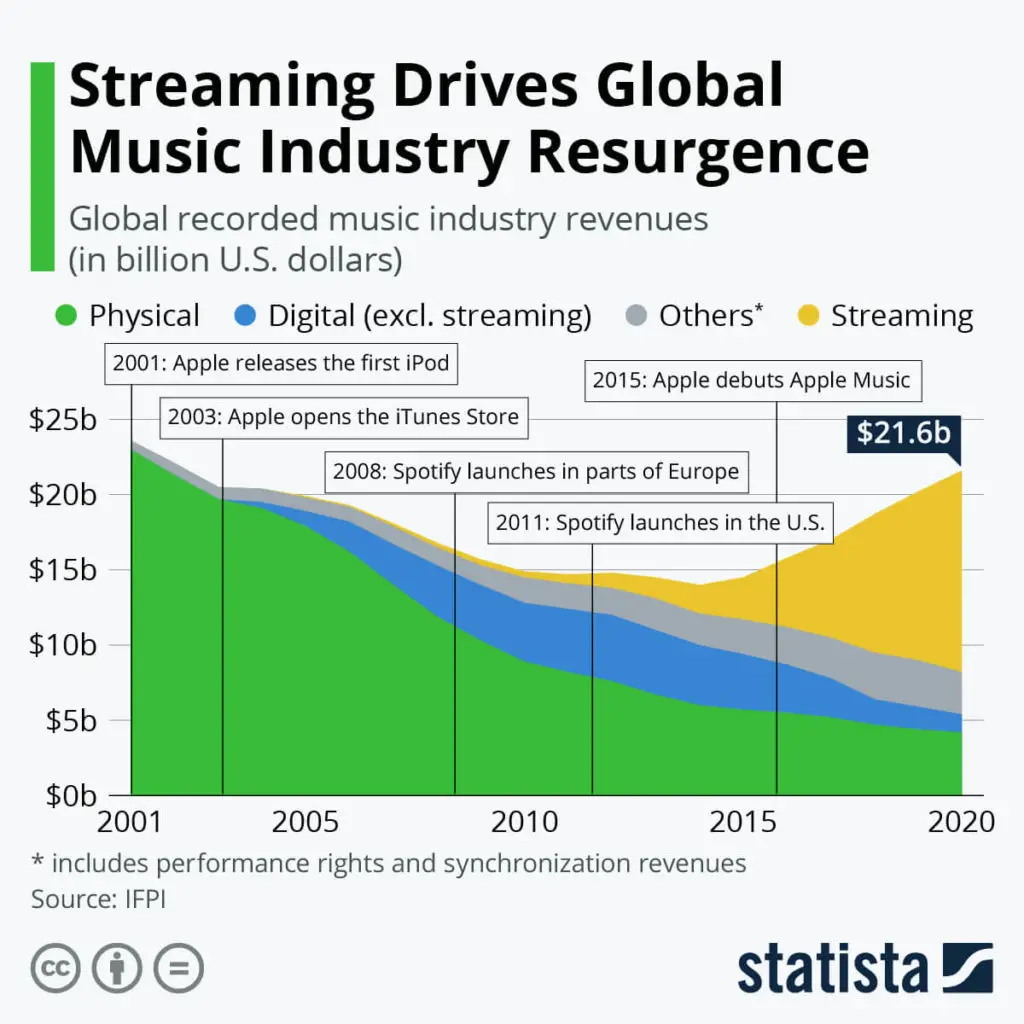

In the last two decades, online music streaming has grown to replace physical CD sales as the primary revenue generator in the music industry.

By 2019, music streaming accounted for more than 56% of the global recorded industry revenues, with the music streaming revenue expected to grow even further and sales through the physical segment expected to decline.

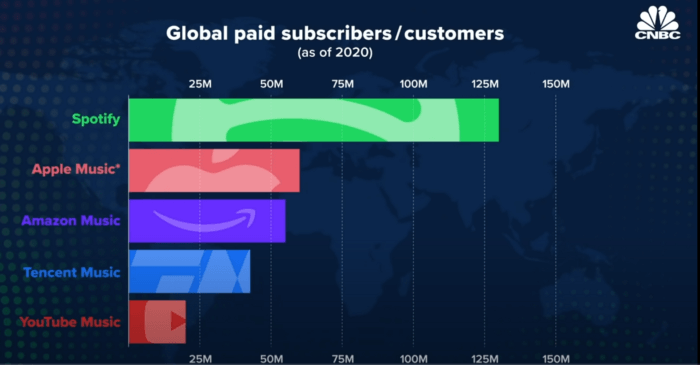

As the music industry shifted from primarily making money through physical mediums like cassettes and CDs to music streaming, Spotify emerged as the clear winner that went on to dominate the music streaming industry. If we were to go purely by the number of paying subscribers, Spotify has more than double the paying users of Apple, its closest competitor.

So how did Spotify go on to become the largest player in the music industry? Let’s find out. Once we’ve discussed Spotify’s rise, we’ll also delve into Spotify’s business model, which is a key driver of its growth engine, and wrap up the piece with an analysis of the competitive landscape of the music streaming wars.

Spotify Founding & Growth Story

When Spotify entered the scene in 2006, the music industry’s evolution had already been underway for years. CDs dominated the music industry up until the late 1990s. The democratization of personal computers coupled with the internet revolution led to the rise of a company called Napster. Put simply, Napster was nothing but a torrent for music. Napster’s free music, even though unethical and illegal, lured people and pulled them away from buying expensive CDs, giving rise to the first wave of the music streaming revolution. In 2001, more than 60 million people were using Napster, only two years after its founding.

Eventually, Napster had to shut down operations. But it didn’t lead people to go back to buying CDs. The notion of purchasing expensive CDs no longer seemed monetarily appealing after people had tasted the elixir of free music. Other piracy websites replaced Napster, and things went back to square one. CD stores were still feeling the heat, and record labels kept incurring millions of dollars of losses in sales.

Amidst all this drama unfolding in the music industry, Steve Jobs came up with the solution of iPods. Steve’s innovation gave music record labels a legal distribution channel, and consumers access to music at a significantly lower price compared to CDs, hitting a sweet spot for parties at both ends of the equation. Once again, record labels began to make massive money as consumers bought iPods in droves, ushering the industry into the second wave of music streaming.

But Apple’s solution still had scope for iterative improvement because not everyone owned an iPod or a MacBook, and not everyone could or wanted to pay for every album.

Spotify built itself upon the weaknesses of Apple’s solution & Napster. Being an internet native offering, Spotify was accessible to everyone, irrespective of what devices they used. Secondly, Spotify employed a freemium model — users could get access to music for free under the ad-supported tier and subscribe to a premium membership if they wanted to unlock special features & remove ads. Spotify removed the limitations of existing solutions like the iPod, but it was not the uniqueness and timing of the idea that turned Spotify into a music giant; it was strategic execution that made the company successful.

Since the beginning, Daniel Ek, Spotify’s CEO, was hell-bent on building a great product to give listeners the best experience possible. Spotify’s first working prototype, named Spotify AB, was completed in four months. But even a year after that, in 2007, Spotify was still in closed beta. At the time, one of the core issues the team worked to solve was latency.

Ek later recalled, “We spent an insane amount of time focusing on latency when no one cared because we were hell bent on making it feel like you had all the world’s music on your hard drive. Obsessing over small details can sometimes make all the difference. That’s what I believe is the biggest misunderstanding about the minimum viable product concept. That is the V in the MVP.”

Once Spotify was satisfied with the MVP, it contacted influential music bloggers in Sweden, their home country, to try what they had built. The strategy proved effective as the bloggers loved the product and helped generate buzz about the new music app. But Spotify didn’t launch for the broader public until 2008.

A breakthrough win for Spotify in its early days was that it was able to convince the “Big Four” American record labels—EMI, Sony, Universal, and Warner Music—and a couple of smaller labels to make their whole back catalogs available on Spotify outside the US for a limited basis. In return, the four big record labels got one-fifth of Spotify’s stock for just 100,000 Swedish krona (approx. $112,000), becoming one of Spotify’s biggest shareholders.

CD sales had already plunged to $16.9 billion in 2008 from $25.2 billion in 1999 and were constantly declining. The deal with Spotify gave record labels limited downside if Spotify failed and unlimited upside if Spotify succeeded. For Spotify, on the other hand, there would have been no existence without the deal since a large selection of music was fundamental to getting consumers to use the product. Spotify launched in October 2008, announcing the news in a blog post that also confirmed its licensing deals with the record labels.

By 2011, Spotify had more than 1 million users across European countries and was looking to acquire new users, which it would find by expanding to America. Spotify launched in America with a novel approach, partnering with a few of America’s biggest brands like Chevrolet, Coca-Cola, Motorola, Reebok, Sprite, and more. Spotify ran display ads for these brands on its freemium offering, and in exchange, they gave exclusive Spotify invitations to their social audiences. The innovative partnership proved beneficial for both Spotify and its launch partners.

Spotify was growing steadily, and the company kept tweaking its product and exploring partnerships to accelerate growth further. In 2013, Spotify made mobile streaming available to all users, previously a premium-only feature. In 2014, Spotify removed all time restrictions for free users. Before doing this, free users were only allowed 20 hours of music for the first six months and 10 hours per month later. Free users could also not listen to the same track more than five times. As Spotify kept removing restrictions from the free tier, it added more features to its premium offering to make it more attractive and get more free users to become paid subscribers.

Amidst all these product improvements, Spotify also integrated with Facebook, becoming the platform’s official music player. The integration also eliminated friction involved in the app sign-up. Users could sign up for Spotify with the tap of a button using their Facebook social profiles. The integration with Facebook helped Spotify get 1 million new Facebook-connected users in only four days.

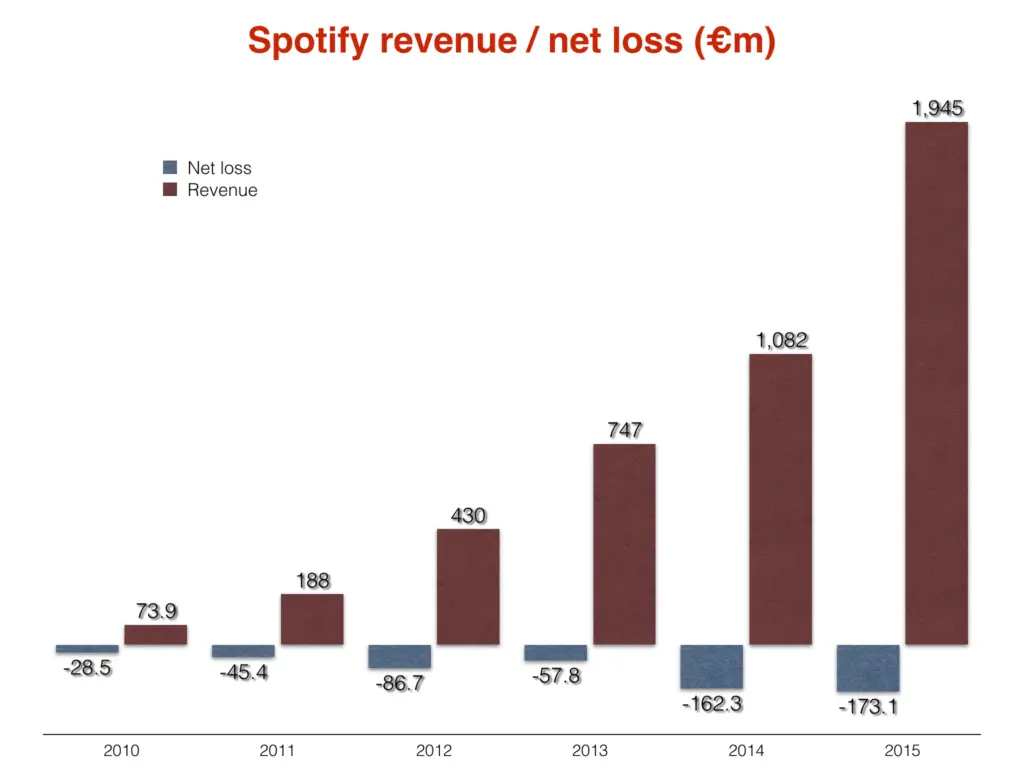

By the end of 2014, Spotify had around $50 million active users, $12.5 million paying subscribers, but losses kept mounting.

Up until the same time, Spotify has paid more than $2 billion in royalties to artists, the main reason for Spotify’s high operational costs. Only growth would keep investor confidence in the product, so Spotify doubled down on making its freemium product even better and delight customers.

In July 2015, Spotify launched a new feature called Discover Weekly, an algorithmically generated weekly playlist that curated 30 songs for every user basis their preferences and listening habits. A year later, the feature has been used by 40 million users, who had collectively streamed 5 billion tracks using this feature. Encouraged by the success of Discover Weekly, Spotify introduced yet another personalization-based feature named Time Capsule, which compiles the top 30 nostalgic tracks from users’ teens and twenties into a playlist.

A year later it went public in 2018, Spotify announced the company was expanding its focus from just a music-only app to becoming an audio-first platform. This shift in strategy meant podcasts would also play a central role in driving future growth. Following the announcement, Spotify acquired the Joe Rogan Experience, the world’s most famous podcast, and signed exclusive deals with Kim Kardashian & DC comics.

In 2021, Spotify also began to host video podcasts on its platform, and there have also been reports that it is testing a TikTok-like feed in its app, which presents a vertical feed of music videos for users to scroll through and optionally like or slip.

Spotify Business Model

Spotify uses a freemium model to make money from two avenues: ad-supported service (free for all users) & its premium subscription service. The free-for-all-users ad-supported service acts as a funnel, leading users to subscribe to the premium service eventually while monetizing them until they decide to upgrade, if at all.

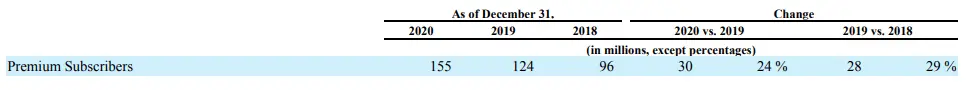

As of December 2020, Spotify was operating in 93 countries and growing, with more than 345 million users using the app actively every month, of which 155 million subscribed to Spotify Premium. Until 2020, Spotify has paid more than €21 billion in royalties to record labels, music publishers, and other rights holders since its launch.

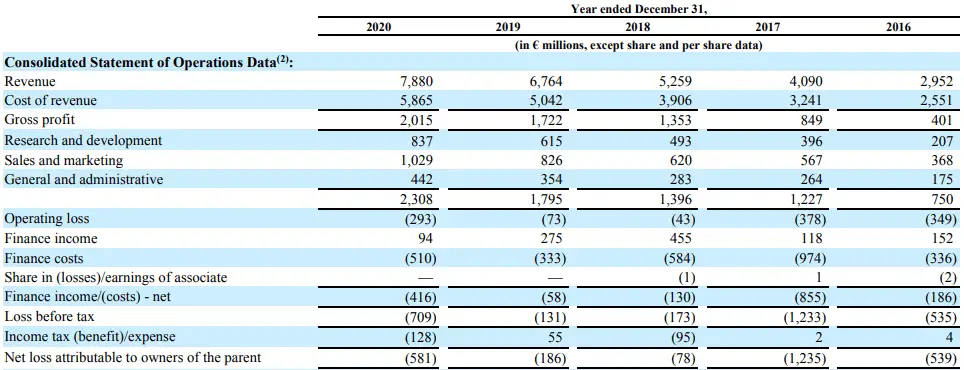

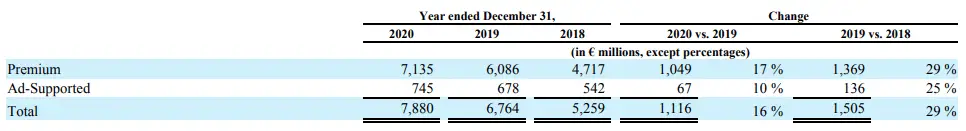

Spotify generated revenue of €7,880 million, €6,764 million, and €5,259 million in 2020, 2019, and 2018, respectively, at a compound annual growth rate of 22%. The streaming giant, though, is yet to record a profit year. In 2020, 2019, and 2018, Spotify recorded net losses of €581 million, €186 million, and €78 million, respectively.

Let’s delve deeper into both of Spotify’s revenue streams to understand how they work & their revenue contribution.

Spotify’s Premium Subscription Service

Unlike its ad-supported counterpart, the premium service comes with exclusive features like ad-free listening, unlimited online and offline access to Spotify’s catalog of music and podcasts in a high-quality streaming environment.

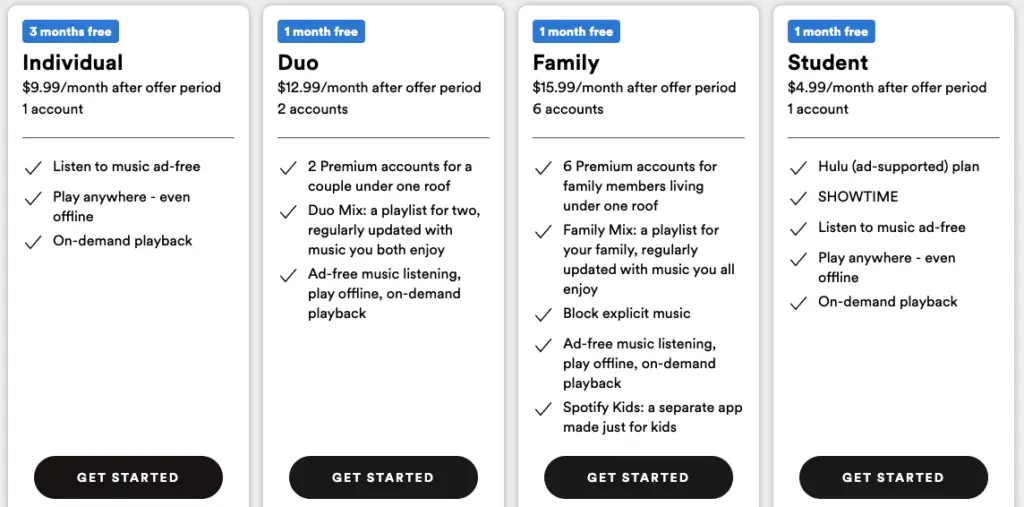

Spotify offers a variety of subscription pricing plans like the standard plan, family plan, duo plan, and student plan to appeal to users with different lifestyles and across various demographics and age groups. The screenshots below mention US pricing for Spotify’s subscription plans, and the pricing varies depending on the market.

Once Spotify has onboarded users to use its free ad-supported offering, the company engages them through both on platform and external marketing efforts by highlighting the superior features of the premium subscription offering, encouraging them to become paying subscribers.

In the years 2020 & 2019, Premium comprised 91% of Spotify’s total revenue. From 2019 to 2020, revenue from the Premium subscription increased €1,049 million or 17%, due to a 24% increase in Premium subscribers.

Here’s what the Premium subscriber growth has been in the years 2018, 2019 & 2020.

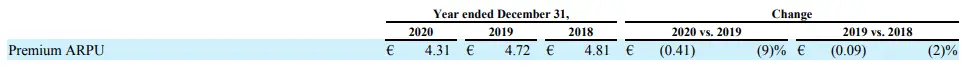

Premium ARPU (Average Revenue Per User), a fundamental metric to gauge the strength of the subscription offering stood at €4.31 in 2020, a 9% decrease from the previous fiscal year. Spotify attributed the decrease mainly to a change in Premium subscriber mix, reducing Premium ARPU by €0.27, and movements in foreign exchange, reducing Premium ARPU by €0.13.

Spotify’s Ad-Supported Service

The ad-supported service is free, but it comes with limited on-demand online access to Spotify’s catalog of music and unlimited online access to the podcast catalog, serving an acquisition channel to push users down the premium subscription path.

The free service is monetized by serving the following types of ads across Spotify’s music and podcast content: display ads, audio ads, and video ads. A large percentage of Spotify’s ad-supported users are between the ages of 18 to 34, a highly sought-after demographic among digital advertisers.

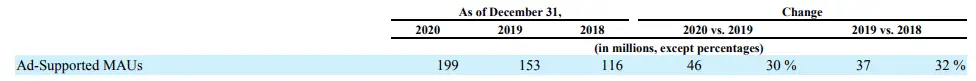

As of Dec 2020, Spotify had 199 million ad-supported MAUs, up from 30% from 2019. Here’s a breakdown of how ad-supported users have grown from 2018 to 2020:

In 2019 & 2019, ad-supported revenue comprised 9% of Spotify’s total revenue. Ad-supported revenue increased d €1,049 million or 17% from 2019 to 2020, mainly due to an increase in revenue from podcasts and the self-serve advertising channel.

Spotify vs Competitors

With 345 million monthly active users & 155 million paying subscribers, Spotify is the leading music service at the moment. Its closest competitor, Apple Music, a premium-only offering has 72 million paying subscribers. In 2020, Apple Music generated revenue of only $4.1 billion compared to Spotify’s close to $9 billion.

However, Spotify netted a loss of close to $657 million in the same year. As far as Apple music is concerned, Apple does not reveal whether the service is independently profitable or not but considering that Apple Music is just another ecosystem product, it serves more function than just an independent revenue stream. Given Apple is a hugely profitable company, it would be safe to assume that Apple has enough gas in the tank to keep the service up and running.

While Spotify’s losses and its independent existence are a cause of concern compared to Apple, Spotify’s edge is that the app is available on both Android & iOS devices, unlike Apple. But Apple’s presence in the music business impacts the revenue Spotify could have otherwise generated from Apple’s premium customers who have higher purchasing power than android users.

The second threat to Spotify, after Apple Music, comes in the form of YouTube Music, which had 30 million paying subscribers until Dec 2020. With more than 2.1 billion active YouTube users, Google has a large enough engaged audience pool to push its music service further.

Apart from Apple Music & YouTube Music, Spotify competes directly with Amazon Music & Tencent Music. With Spotify shifting its focus to becoming an audio platform, time will tell if podcasts will help Spotify differentiate itself. After all, Apple & Google have standalone podcast products that they can bundle together with their music offering.

Read More Case Studies

WhatsApp Business Model Case Study

YouTube Business Model Case Study

Google Business Model Case Study