In today’s digital age, online transactions have become a vital part of daily life. Whether it is paying for your groceries or booking a flight, most transactions are carried out digitally. To facilitate these transactions, there are several payment processors in the market, but one that has made a significant impact is Stripe. Stripe is a payment processing company that has revolutionized the payment industry with its innovative approach. In this article, we will delve into Stripe’s business model, revenue, and how it has become one of the most successful companies in the world.

Introduction to Stripe:

Stripe was founded in 2010 by John and Patrick Collison, two Irish brothers who were also the founders of Auctomatic, a startup that was sold for millions of dollars. Stripe initially launched as a platform that developers could use to integrate payments into their applications. The company has since expanded its services and now offers a range of payment-related products and services, including online payments, subscription billing, and fraud detection.

Stripe’s Business Model:

Stripe’s business model is simple but effective. The company provides a platform that allows businesses to accept payments from customers online. Stripe charges businesses a fee for each transaction that they process. The fee varies depending on the type of transaction and the country where the transaction takes place. Stripe’s fee structure is straightforward and transparent, which is a key selling point for many businesses.

One of the most significant advantages of Stripe’s business model is that it is easy to use. Businesses can integrate Stripe’s payment processing into their websites or applications with just a few lines of code. Stripe provides a range of APIs and libraries that make integration simple, which means that even small businesses can start accepting payments online quickly.

Another advantage of Stripe’s business model is that it is scalable. The company’s platform can handle payments from small businesses to large enterprises with ease. This scalability has helped Stripe to become one of the most popular payment processors in the world.

Revenue:

Over the course of 20 rounds, the company has raised $2.3 billion in capital. It is referred to as a unicorn startup, a designation saved for businesses with a worth more than $1 billion.

One of the most highly valued privately owned enterprises in the US is Stripe. Investors last assigned the business a value of $95 billion in 2022. Over the course of the pandemic, Stripe revenue grew quickly. It does not anticipate a repeat of similar growth in the upcoming years, though.

Internally, Stripe reduced its estimate to $74 billion, a 38% decrease. This choice was made based on a 409A value, which was determined by a third party as opposed to venture capitalists. Public enterprises are declining, notably in the technology sector. Stripe continues to be profitable despite its internal valuation being lower.

A developer-friendly method of online payment acceptance is Stripe. Additional services like Stripe Radar, which aids organisations in thwarting online fraud, are included.

Two of Stripe’s biggest rivals for a piece of the payment processing market are Square and PayPal. PayPal is the business with the largest market share. While PayPal caters to smaller businesses, Stripe targets companies of all sizes.

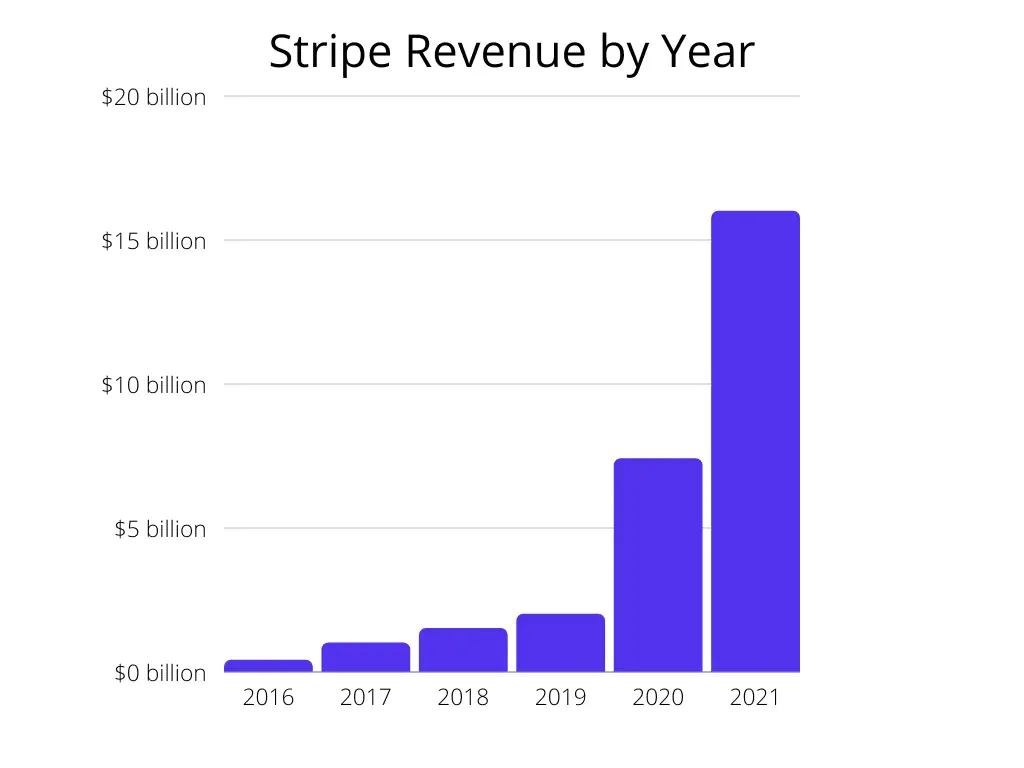

60% More Stripe Revenue in 2021:

Year over year, Stripe income has steadily increased. The business generates revenue by taking a share of each transaction, typically 2.9% + $0.30 for successful charges on most cards. Additionally, there are additional fees for currency conversions and foreign transactions. Compared to PayPal, its primary rival, it charges lesser fees.

The pandemic contributed significantly to the company’s sales growth in 2020 and 2021. Stripe’s revenue increased by 60% in 2021 as more people used contactless payments and more individuals conducted business online.

Its revenue in prior years was:

2016: $450 million in sales

2017: $1 billion in sales

2018: $1.5 billion in sales

2019: $2 billion in sales

2020: $7.4 billion in sales

How Stripe has become what it is now:

Stripe’s success can be attributed to several factors. One of the main factors is the company’s focus on simplicity and ease of use. Stripe has designed its platform to be easy to use and integrate, which has made it a popular choice for businesses of all sizes.

Another factor that has contributed to Stripe’s success is its commitment to innovation. The company has continued to expand its services and products, introducing new features and tools that help businesses to manage their payments more efficiently. Stripe has also invested in research and development, which has helped the company to stay ahead of the curve in the payment industry.

Stripe’s success can also be attributed to its customer-centric approach. The company has built a strong reputation for providing excellent customer service and support. Stripe’s customer support team is available 24/7, which means that businesses can get help whenever they need it. This has helped Stripe to build a loyal customer base that is committed to using the company’s services.

Another key factor in Stripe’s success has been its ability to adapt to changing market conditions. The payment industry is constantly evolving, and Stripe has been able to keep up with these changes by introducing new products and services that meet the needs of businesses and consumers.

Stripe’s acquisition strategy has also played a significant role in its success. The company has made several strategic acquisitions over the years, including the acquisition of Paystack, a leading payment processor in Africa, and the acquisition of TaxJar, a tax automation company. These acquisitions have helped Stripe to expand its global reach and offer new services to its customers.

Finally, Stripe’s success can be attributed to the vision and leadership of its founders, John and Patrick Collison. The brothers have a clear vision for the future of the payment industry and have been able to guide Stripe through its rapid growth and expansion.

Conclusion:

Stripe has revolutionized the payment industry with its innovative approach to payment processing. The company’s focus on simplicity, scalability, and innovation has helped it to become one of the most successful payment processors in the world. Stripe’s revenue has grown rapidly since the company was founded, and its customer-centric approach has helped it to build a loyal customer base.

Stripe’s success can be attributed to several factors, including its commitment to innovation, customer-centric approach, and ability to adapt to changing market conditions. The company’s acquisition strategy has also played a significant role in its success, as has the vision and leadership of its founders.

As the payment industry continues to evolve, Stripe is well-positioned to continue its success and shape the future of payments.