In 2016, 13 years after being in existence, Tesla made a one-word switch in its mission statement.

The old mission statement read, “Tesla’s mission is to accelerate the world’s transition to sustainable transport.” The updated mission statement became, “Tesla’s mission is to accelerate the world’s transition to sustainable energy.”

I highlight this change because it opens up a different window to peek into the house of Tesla. The general perception built around Tesla is that it is a car company focused on speeding up our transition to electric or sustainable transport, but the mission statement change and newer product lines indicate that a car company is not all that Tesla intends to be.

That said, Tesla (initially Tesla Motors) started as a car company to disrupt a decade-old, established industry and gradually outgrew its original vision. To understand the full timeline of Tesla, we need to begin with why the company saw an opportunity to disrupt the arguably stagnating car industry. And for that, we need to go back in time for a short history of cars.

The first working vehicles were developed in the late 18th century, but it wasn’t until the first half of the 20th century that cars became a relatively common phenomenon. Until 1895, these vehicles were either powered using steam or electricity. Both power sources, though, came with their own set of shortcomings. Steam-powered cars had long startup times — up to 30 minutes — and had a limited range because of the need to be refilled with water. Electric vehicles, again, had a limited range and were expensive compared to their gasoline-powered counterparts, eventually leading to the mass adoption of the latter.

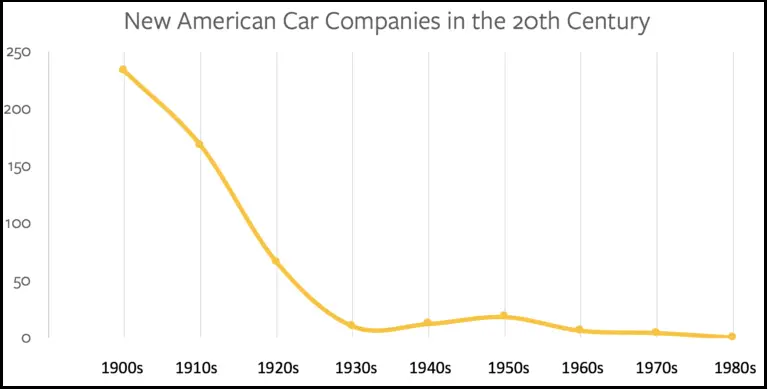

As the market for gasoline-powered vehicles matured, the number of automobile manufacturers founded in America, which was the leading manufacturer at the time, plateaued.

Electric vehicle tech also took a backseat as gasoline became the preferred power solution used to propel cars. By the beginning of the 1970s, interest renewed in electric vehicles due to soaring oil prices and gasoline shortage. However, vehicles developed still had performance issues — usually a top speed of 45 miles per hour and a typical range of 40 miles before the need to be recharged. The failure to build a feasible electric car killed interest in an electric vehicle once again.

Fast forward 20 years, General Motors tried its hand at making an electric vehicle. GM’s new model, called EV1, had double the range of the EVs developed in the 1970s and the ability to accelerate from 0 to 50 mph (0-80 km/h) in 6.3 seconds. The general populace showed interest in EV1, but GM discontinued the EV1 in 2001 because of high production costs and commercial inviability.

Tesla’s Business Plan & Growth Story

The failure of GM’s EV1 corresponded with the founding of Tesla Motors in 2003. At the time, the consensus among large automakers was that electric cars were inevitable, albeit in the distant future. Tesla challenged the ‘distant future’ notion with a three-pronged grand plan.

The first step was to demonstrate that it was possible to build a high-performance electric sports car that could beat gasoline sports cars like Porsche or Ferrari in a head-to-head showdown. The vehicle was also to have a then unfathomable range per charge.

But why did Tesla choose to build a sports car first instead of a general-purpose car? Well, there were a couple of reasons for that. First of all, Tesla would try to push the battery technology beyond its existing limitation, so mass manufacturing a general-purpose car would be monetarily risky. On the other hand, developing a limited number of expensive sports cars would help Tesla Motors prove its foundational premise, generate broader interest, and make money to invest in building an affordable car.

The prototype for this sports car, the first generation Tesla Roadster, was first shown in 2006. Its finished version boasted a never seen before 320 kilometers range per charge, a top speed of 201 km/h, and the ability to accelerate from 0 to 97 km/h (0 to 60 mph) in 3.7 or 3.9 seconds, depending on its model. Tesla sold around 2450 Roadsters in over 30 countries, pricing them in a range of $80,000 to $120,000.

Roadster’s successful development & positive adoption helped check the first step of Tesla’s plan. The second step was to build a more affordable, medium volume car, and the third was to iterate on the second car to make it more affordable and increase production volume. Cracking affordability was essential because it would accelerate the mass adoption of electric vehicles.

In Jan 2012, Tesla discontinued Roadster’s manufacturing and launched its second car, the Model S luxury Sedan, at a base price of $57,400. The Model S won several automotive awards in 2012 and 2013, including the 2013 Motor Trend Car of the year, and it also became the best-selling electric car worldwide in 2015 and 2016. As part of the second step of the plan, Tesla also launched a luxury SUV, named Model X, in 2015. Model S & Model X, the two cars, ensured Tesla catered to both the premium sedan and SUV customer segments.

Tesla launched its most affordable car, the $35000 Model 3, targeted at the mass market in July 2017, executing the third step of its plan. For three consecutive years, from 2018 to 2020, Model 3 has held the record for being the world’s top-selling electric car.

Building Electrics cars affordable was Tesla’s primary idea. But the plan also included providing zero-emission electric power generation options at the same time. Originally, Tesla was to just co-market sustainable energy solutions from other companies along with its car. For example, Tesla was to offer solar panels made by SolarCity. And this wasn’t entirely out of altruistic tendencies; it also made sense for Tesla’s mission of accelerating the transition to electric vehicles. Having solar panels installed on home rooftops would help generate free energy for home usage and charge Tesla cars.

In 2015, Tesla launched its energy storage battery, Powerwall, to store energy generated from these Solar panels. A year later, Tesla acquired SolarCity as it would allow them to integrate energy generation and energy storage seamlessly. After the acquisition, Tesla updated its mission statement to reflect its new vision of accelerating the world’s transition to sustainable energy.

In the same year(2016), Elon Musk revealed the second edition of Tesla’s plan. A predictable move, the plan laid down the foundation for Tesla’s expansion beyond cars, building electric versions of heavy-duty trucks and high passenger-density urban transport. While Tesla did demo Semi(a heavy-duty truck) & Cybertruck(a light-duty truck) in 2017 and 2019, respectively, production of both these vehicles is slated to begin in 2021.

Apart from expanding into all major electric vehicle segments, Tesla’s 2016 plan also envisioned a world where cars would be fully autonomous. And in this futuristic world, an idle car will make money for its owners by becoming a part of Tesla’s self-driving taxi fleet. You could think of the service as Airbnb for ride-sharing.

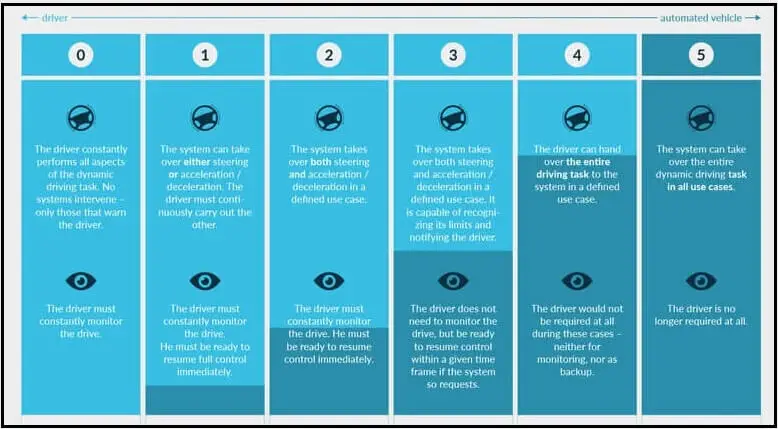

As far as the practical implementation goes, we are yet to reach fully autonomous self-driving. To develop a better understanding of how far we are from self-driving tech, we can use the five-level autonomy classification of the society of Automotive engineers.

L1 comes with driver assistance, where the vehicle can control either braking or acceleration, but not both simultaneously. L2 can handle both braking & acceleration simultaneously, but drivers must pay attention at all times. L3 is conditional automation, where the driver can temporarily take eyes off the road but should be alert enough to take control of the cars if the system requests. L4 is advanced automation, where the car takes full control, giving the driver the liberty to do whatever he wants. However, one important thing to note is that L2, L3 & L4 work only within a predefined use case. It’s only Level 5, which is entirely autonomous, meaning it does not require a human driver in any circumstances and can operate in all use cases.

Self-driving vehicles, including the ones marketed by Tesla as self-driving, do not have Level 5 capabilities, so Tesla’s plan of autonomy-enabled idle car ride-sharing seems distant, at least at the time of writing.

Tesla’s Business Model

Tesla operates in two business segments: Automotive and Energy Generation & Storage. In its 2020 financial report, Tesla shared revenue and profit breakdown of both these segments and sub-segments within the parent segments.

Automotive

Tesla’s automotive segments consist of automotive sales revenue, automotive leasing & sales of regulatory credits. Tesla earns through regulatory credits because 11 US states require automakers to sell a certain percentage of zero-emission vehicles by 2025. If they can’t, automakers have to buy regulatory credits from automakers like Tesla that meet those requirements.

To add to the three aforementioned revenue sources in the automotive segment, Tesla also makes money from non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, and vehicle insurance.

In FY 2020, the automotive segment accounted for 94%($29.5 billion) of Tesla’s total revenue($31.5 billion) & 99.73% of the $6.6 billion total gross profit.

Energy Generation & Storage

Tesla’s energy segment consists of installation, sales, and leasing of solar energy solutions and related services. In FY 2020, the energy segment accounted for 6%($2 billion) of Tesla’s total revenue($31.5 billion) & a meager 0.27% of the total gross profit.

Tesla’s Geographic Revenue Breakdown

Tesla’s key market is the US, which made up around 48%($15.2Billion) of 2020 revenue($31.5 billion). China, Tesla’s secondary market, contributed 21%($6.6 billion). And other countries around the globe accounted for the remaining 31%(9.6 billion)

Tesla’s Market Share

To quantify Tesla’s future potential & current standing within the car segment, its biggest source of revenue at this time, we need to look at two variables: the worldwide car market and Tesla’s share of the pie among electric car manufacturers.

In 2020, 63.7 million cars were sold worldwide, out of which only an estimated 3.1 million were electric vehicles. Since electric vehicles only made up for less than 5% of the total car sales, there’s obviously room for potential upside in the electric market. Tesla’s made up the highest sales volume of these electric vehicles, 0.5 million cars, or 16% of the electric car market.

But will Tesla be able to hold on to its lead as established car manufacturers go after electric cars?

Only time will tell.

If you liked this piece, you might also like our article covering ‘How Harvard Makes Money‘. And if you thought student tuition is the only way Harvard makes money, you’re in for a surprise.

![Tesla Business Model: How Tesla Makes Money [2021]](https://whatisthebusinessmodelof.com/wp-content/uploads/2021/03/HowTeslaMakesMoney.png)