When the startup world thought about digitizing commerce in India, it first pursued the B2C sector. And this is evident in the fact that companies, like Flipkart & Amazon, which went on to disrupt commerce in India by nudging people online were mostly focussed on reaching consumers directly themselves(first-party sales) or focused on empowering businesses to reach customers through their third-party marketplace model.

But this model of doing businesses failed to recognize or choose to ignore that India is market driven by small and medium scale businesses that source products from each other, leading to the presence of a huge B2B market amongst themselves. An already existing massive B2B structure which was, and still is, in a way, the lifeblood of the Indian company (India has 6.3 crore SMEs) meant there was a huge opportunity in using Internet technology to empower these SMEs. Empowering these SMEs meant helping them do what they already do more efficiently using technology instead of disrupting them.

And this is what the three founders of Udaan — Amod Malviya, Vaibhav Gupta, Sujeet Kumar — who had worked at Flipkart since almost its founding days decided to do in 2016.

When the three decided to start up together, they also decided the idea they would work on should fulfill three criteria — they wanted to work on solving a problem native to India, build a product with a uniquely Indian flavor, and use technology to empower a large number of people. The Indian B2B market fit all three criteria. In 2016, Udaan, a B2B platform focussed on catering to Indian businesses took flight.

Now, we know Udaan was looking to empower small Indian businesses but to understand how Udaan works and why such a platform was even needed in the first place, we need to understand the challenges small businesses were facing before Udaan came to their rescue.

The B2B supply chain of Indian SMEs usually works in the following fashion. Once the manufacturer has manufactured the products, wholesalers will source products from them and sell them to retailers. In some cases, retailers could also source products directly from the wholesalers. However, because retailers have access to only a few sellers(manufacturers & wholesalers) and not sellers across the whole nation, they were not able to get the best prices.

In the case of sellers, they can also only work with a limited set of people because they would only be doing business with retailers they know personally due to trust issues over payment dues.

Other than this, the supply chain for B2B was also underdeveloped in India, leading to further issues for small businesses. The fact that the whole B2B market operated majorly on credit also led to people mostly doing business with people they knew they could trust, further limiting the expansion capabilities of these small businesses.

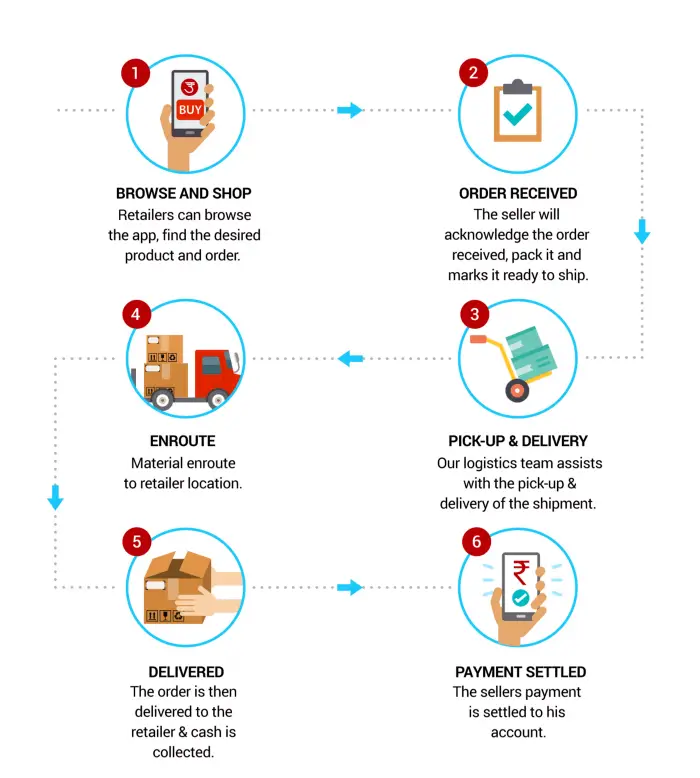

By building a marketplace to connect sellers with retailers, Udaan enabled sellers to connect with retailers across the country, and retailers to source products from sellers across the country. When retailers place an order using Udaan, the company’s logistical arm, Udaan Express, also takes care of delivery.

By taking care of logistics itself, Udaan solves another problem piece for small businesses across the country. While established corporations like Hindustan Unilever have extensive country-wide supply chains, one of the reasons why small businesses would not be able to compete with them was because of supply chain issues. B2B parcels were usually bigger in weight and the existing logistical solutions were not well placed to serve the B2B segment.

The third and the largest barrier to small businesses was the lack of credit support from financial institutions like banks. Despite persistent efforts by the banks and policy intervention by the governments, banks have not been able to close the funding gap for small businesses. On the bank side, the small amount of lending might not seem attractive. On the small business side, the documentation required for getting a loan would be a hassle. In most cases, this lending gap would be filled by sellers, who give credit to the retailers.

Udaan solves the problem of financing for small businesses by providing them with up to 5 lakhs worth of credit through Udaan Capital. Because Udaan has access to heaps of data of business happening through its platform, it has a better ability to determine which small businesses are worthy of giving credit. At the time of writing, Udaan Capital has disbursed 7000+ crores to 1 lakh+ businesses across 500+ cities.

By solving these three problems — information asymmetry, logistics & lending — Udaan has empowered the small business economy of India like never before by becoming a technology partner. At the time of writing, Udaan is the largest B2B platform in India, connecting 30 lakh+ retailers with 25,000 sellers across 900 cities.

Udaan Business Model

Udaan makes money from the following seven different sources: cash collection fees from merchants, delivery charges from merchants, warehousing services to store products, In-app advertising for sellers, Interest income from credit services, App analytics services, and other Value-added services.

Let’s take a look at each of these revenue sources individually to understand them better.

Cash collection: Udaan accepts payments from buyers for the sellers either physically or online, and charges a cash collection fee for the same.

Logistics: As a logistics provider, Udaan collects delivery charges for transporting the goods from the sellers to the retailers. Udaan also charges extra fees for transporting products that are returned back to sellers.

Warehousing: Registered Udaan Sellers can also store their products in Udaan operated warehouses. In exchange for storing the goods, Udaan charges sellers. Sellers chose to store goods with Udaan due to storage facility shortages and to enable faster delivery of products to retailers.

Advertising: When a tech company operates a marketplace and collects a huge amount of data, advertising is one of the ways it unlocks value from its platform. Udaan gives manufacturers and wholesalers the option to reach more retailers with targeted advertising.

Financing: Through its credit extension arm, Udaan extends credit up to 5 lakhs to merchants, and monetizes this service by charging them interest on the same.

App Analytics: Considering Udaan sits on a large amount of valuable data, it also monetizes this data by enabling brands and manufacturers to make well-informed decisions about product launches and testing of new products in different markets.

Value-Added Services: Udaan offers other fee-based services like packaging and printing labels on products, the printing of invoices, and more to registered sellers.

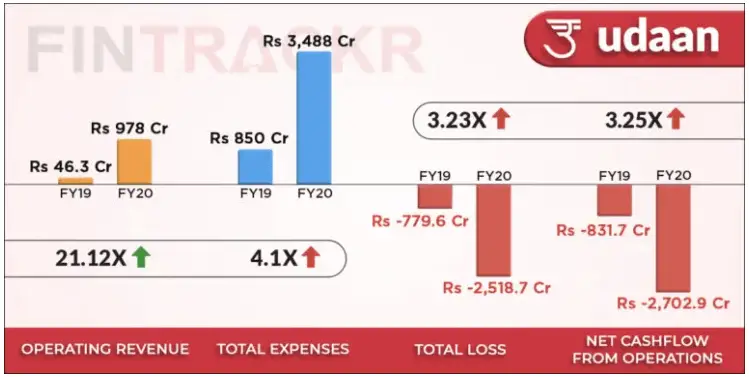

In FY20, Udaan scaled its revenue to Rs 978 crore, up 21x from the Rs 46.3 crore it earned in FY19. Udaan’s expenditure shot up 4x to Rs 3488 crore in FY20 from its expense of Rs 850 crore in FY19. As one can deduce from the numbers, Udaan is yet to attain profitability.

Udaan Funding, Valuation & IPO

As of the time of writing, Udaan has raised $1.5 billion in total across 11 funding rounds since its inception. After its funding round of $280 million in January 2021, Udaan was valued at $3.1 billion.

In Jan 2022, Udaan raised another $250 million via convertible notes and debt. The move is expected to set up Udaan for an IPO in the next 18 months, giving its valuation a boost at the time.