While Zomato was started as a simple restaurant listing directory in 2008, the company has come a long long way since then venturing into multiple business segments, making the business more diverse than a Zomato user interacting with the business would think it to be.

In this blog, we will try to demystify Zomato’s business model. But before we do that, let’s take a look at its founding story & how the company has evolved over the years to establish better context.

Zomato Founding & Growth Story

The only person who has always been involved in the operations of Zomato is the current CEO, Deepinder Goyal. He first launched what would eventually come to be known as Zomato with a friend called Prasoon Jain under the name foodlet.in in the Delhi NCR region.

But Prasoon left soon and shifted to Mumbai, leaving the company struggling. And that’s when co-founder Pankaj Chaddah joined Deeepinder’s venture. At the time, they began afresh by changing the name of the company from Foodlet to Foodiebay.

By Dec 2008, in a matter of 9 months, the company grew to become the largest restaurant directory in the Delhi NCR region. After seeing success in the Delhi NCR region, the company soon expanded to other cities like Bengaluru, Chennai, Pune, Ahmedabad, and Hyderabad.

By 2012, Zomato had started its international expansion, extending its services to countries like the UK, South Africa, UAE, Qatar, Sri Lanka, South Africa, the UK, and the Philippines. New Zealand, Turkey, and Brazil got added to the list in 2013.

In the midst of all of this growth, the company had to go through a minor naming glitch which led to changing the name of Foodiebay to Zomato.

Since the last four letters of ‘Foodiebay’ were ‘eBay’, the company’s name was changed to Zomato in 2010 to avoid any legal issues. Ironically, the company got a legal notice from eBay 5 days before changing their name to Zomato. But since they had already initiated the name change process, they did not have to fret over it.

In its initial years, Zomato’s primary money-making source was restaurant advertising, much like any other aggregator that aggregates user attention & sells it to advertisers. In its 2019 Financial report, Zomato highlighted that up until 2016, restaurant advertising represented their 100% revenue & focus.

However, Zomato’s focus started changing in 2015, after which it launched three new business segments in the years that followed.

In around mid-2015, the company forayed into the food delivery business.

In Nov 2017, Zomato launched Gold (Now Zomato Pro) in India, a subscription product, under which subscribers get additional discounts on Dining & Delivery. Discounts come out of the pocket of restaurants as they see incremental revenue from being a part of the Zomato Pro program. In 2021, Zomato also launched Zomato Pro Plus, another subscription offering with a benefit of free delivery on all order. Unlike Zomato Pro, which is funded by restaurants, the free delivery in case of Zomato Pro Plus is funded by Zomato.

In August 2018, Zomato launched a new initiative called Hyperpure, under which Zomato works directly with Farmers to improve the quality of food produced & then supplies the fresh produce to restaurateurs, thereby improving the quality of food people eat.

In its FY19 annual report, Zomato mentioned that it had stopped considering advertising as a standalone P&L. Instead, the company was viewing its business as a combination of three key large pillars — Delivery, Dining Out, and Sustainability(Hyperpure).

As it often happens in the startup world, Zomato’s strategy underwent a big change in the next two years, more so with the pandemic bringing the business of Zomato’s partners, and thereby Zomato, to an unprecedented standstill.

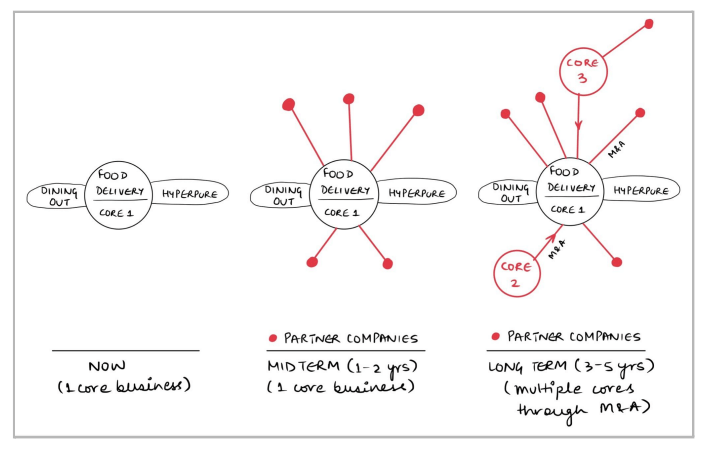

In its FY22 Q2 Report, a little later after its public listing on the Indian stock market, Zomato laid out an updated vision for its business. Under this new vision, Delivery, Dining Out & Hyperpure ( previously referred to as sustainability ) will continue to be the growth levers for Zomato. However, Zomato will also look to develop the Indian e-commerce ecosystem by investing and partnering with other companies to grow beyond its core food offerings. Now, the question is why would Zomato want to take this route. Here’s the rationale behind it, in Zomato’s own words,

“Our business today is at the confluence of food and hyperlocal e-commerce. What powers our business is the last mile hyperlocal delivery fleet, which is now 300,000+ delivery partners strong on a monthly active basis. We believe that our last mile fleet is a strong moat and it sets us up well for building one of the most meaningful hyperlocal e-commerce companies in India in the long term. We are bullish about the various use cases that we can plug our delivery fleet into, and we think we can be the primary contenders for building large businesses in hyperlocal e-commerce in India. Keeping this long term view in mind, we have started investing in hyperlocal e-commerce companies (including e-commerce enablers). Over time, the idea is to add multiple large core businesses to the existing core. Here’s how we envision this to work –

As these businesses scale, we would want to be the provider of additional capital to these businesses and consolidate our stake leading to a potential merger at some point (at least in some cases, if and when the founders of these companies want to). In the worst case, we would want these investments to generate huge learnings and great financial returns for Zomato.”

One important thing to note about Zomato is that the company shut down all of its international units (other than the dining-out business in UAE ) in a bid to minimize losses and focus primarily on the Indian market.

Zomato Business Model

Zomato currently makes money from three business segments: Food Delivery, Dining Out & Hyperpure. The Food Delivery segment earns commissions from restaurants and delivery charges from customers. Dining out generates revenue mainly from Zomato Pro & Zomato Pro Plus. Hyperpure makes money by selling ingredients to restaurants.

Let’s have a look at how each segment fares individually.

Food Delivery

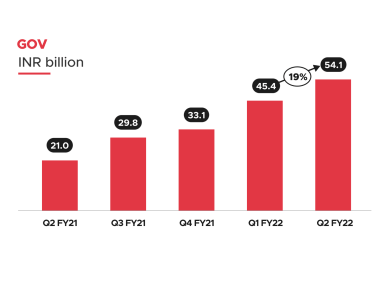

Since Q2 FY21, revenue from Zomato’s food delivery segment has been trending upwards. Gross Order Value (“GOV”) grew by 19% QoQ in Q2 FY22 and 158% YoY to INR 54.1 billion ($721 million).

According to Zomato, this growth was driven by an increase in the number of transacting users, number of active food delivery restaurants and active delivery

partners.

Dining Out

In the last few years, Zomato has ventured aggressively into the Dining Out segment. It has launched a range of initiatives like Zomato Pro & Zomato Pro Plus. As of Q2 FY22, between Zomato Pro & Zomato Pro Plus, Zomato had 1.5 million members & over 25k restaurant partners in India.

Hyperpure

Hyperpure is Zomato’s initiative to improve the quality of ingredients used by restaurants.

On the supply side, Zomato helps farmers grow crops that are pesticide and chemical-free by providing them with surety of demand cycles, technological guidance & better prices.

Restaurants that buy ingredients from Hyperpure are recognized through a ‘Hyperpure Inside’ tag on Zomato. Not only does the ‘Hyperpure Inside’ tag help users make informed choices, but it also highlights a differentiation between Hyperpure & non-hyperpure restaurants, eventually leading more restaurants to switch to Hyperpure since Zomato users would get habituated to prefer Hyperpure restaurants over non-hyperpure restaurants.

In Q2 FY22, revenue from Hyperpure grew by 49% QoQ to INR 1.1 billion ($15 million). Hyperpure service is present in 8 cities and Zomato supplied ingredients to over 12,000 restaurants every month on an average in Q2 FY22.

Is Zomato Profitable?

Driven by the pandemic, Zomato’s revenue dropped from Rs 2742 crores in FY20 to Rs 2118 crores in FY21. In the same time frame, expenses also decreased from Rs 5006 crores to Rs 2608 crores. While Zomato managed to cut down losses in the pandemic, the company is yet to turn profitable.

Read More Case Studies

TikTok Business Model Case Study

BYJU’s Business Model Case Study

McDonald’s Business Model case Study