Started 79 years ago, in 1943, IKEA has gone on to become the largest furniture retailer. And like any brand that goes on to become a market leader, IKEA pioneered multiple innovations in its industry. To add to that, IKEA, in recent years, has also adapted itself to stay relevant in the digital era.

In this blog, we will dive into the strategies that propelled IKEA to the top of the furniture industry, look into how IKEA has maintained relevancy in the digital world and understand IKEA’s business model.

IKEA Founding & Growth Story

Like most entrepreneurs who impact the world, IKEA’s founder, Ingvar Kamprad, had an entrepreneurial streak since he was a child. He first took baby steps in the business world, at age 5, by selling matches. He enlisted his aunt, who lived in Stockholm, to buy big, less expensive cartons of matches and send them to him in the Swedish province of Småland, where he lived. Ingvar would then split the matches into smaller packages and resold them at low prices. Although Ingvar could source them cheap, selling matches wasn’t a good enough business, leading him to quit.

Later on, Ingvar dabbled in selling pens, watches & wallets in college, but he finally settled for furniture. One of the reasons IKEA’s furniture became distinguishable in its early days was due to its pricing philosophy.

“To design a desk which may cost $1,000 is easy for a furniture designer, but to design a functional and good desk which shall cost $50 can only be done by the very best,” a famous quote from Ingvar formed the foundational pillar of IKEA’s operating philosophy.

IKEA’s prices were so low that many Swedish furniture retailers felt threatened by them. They even teamed up together to pressure suppliers to boycott IKEA products and prevent Ingvar from exhibiting at furniture fairs. At around the same time, IKEA launched its first annual IKEA home furnishing catalog, which one could say, was, content marketing in its primitive form.

A few years later, IKEA launched its first store in Älmhult, Sweden, in 1953. It was during this year that IKEA revolutionized the furniture industry with the launch of flat-pack furniture. For the uninitiated, customers themselves assemble flat-pack furniture, which consists of separate furniture components packed into cartons with assembly instructions.

Furniture retailers like IKEA benefit from selling ready-to-assemble furniture because assembled furniture is more expensive to store and deliver. In the case of flat-pack furniture, since the assembly work is done by the customers, the overall pricing of the furniture turns out to be lesser.

Now, to be clear, IKEA didn’t invent the concept of flat-pack furniture. The idea existed before IKEA, but the company played a significant role in popularizing the concept. And in doing so, the company leveraged the physiological hack now referred to as the IKEA effect.

The IKEA effect states — “that labour alone can be sufficient to induce greater liking for the fruits of one’s labour” — meaning assembling IKEA’s flat-pack furniture themselves induces the customer to value furniture even more. And research has shown that when people build or create something themselves, the act of making also subtly nudges them to be willing to pay more for their creation. In the case of IKEA, this meant people perceived they have attained ‘greater value for money’ because they assemble the furniture themselves.

Besides the IKEA effect, how IKEA designs its store layouts has also largely contributed to its success. Stores are designed in a circular format and use a one-way system. Because of the circular design, buyers can’t see what is coming next & fear they’ll miss out on something they need if they don’t continue to the end. The stores have potential escape points throughout them, but using them would mean customers miss several sections, and they take that risk infrequently. And since it would take extra effort to revisit a particular item later, customers are inclined to pick them up when they see it. In 2019 alone, around 1 billion people worldwide visited such IKEA stores designed to maximize customer spending. The number of visits reduced to 825 million and 775 million in 2020 & 2021 respectively, partly due to the COVID-19 pandemic.

To get potential buyers to spend more time shopping, IKEA stores also feature restaurants. You might think that luring people to shop more by providing eatery options is a common feature among offline brands today. Still, it wasn’t as common back when IKEA incorporated the idea in its marketing mix.

As we’ve seen, low-cost flat-pack furniture & well-designed stores unique store designs played a significant role in making IKEA a big player in the furniture industry in the offline-dominated, pre-internet era. But in recent years, IKEA has also adapted to the new age digital world.

In FY20, e-commerce accounted for more than 16% of total retail sales compared to 10% in FY19. This sharp increase in online sales was mainly due to the coronavirus, but IKEA had incorporated the online channel as a part of its sales mix before the pandemic. In FY21, the online segment contributed to 26% of IKEA sales.

As part of its digital transformation strategy, IKEA also launched an augmented reality app that buyers can use to visualize how a piece of furniture would look in their homes.

IKEA Business Model

IKEA makes money from two different sources: an offline franchise-driven setup & a direct-to-consumer online setup. In the franchise setting, IKEA charges an annual fee of 3% on net sales to franchisees. Apart from franchise fees, IKEA also makes money from wholesale selling of IKEA products to franchisees & other income. The other income mainly revenue consists of money generated from the IKEA catalogue and other marketing materials created for IKEA retailers.

As of FY21, IKEA franchisees operated 458 traditional IKEA stores in 61 markets as well as several test locations. In FY22 IKEA franchisees will enter three more

new markets: Puerto Rico, the Philippines, and Oman. IKEA owns and operates only one store by itself (non-franchise) in the Netherlands.

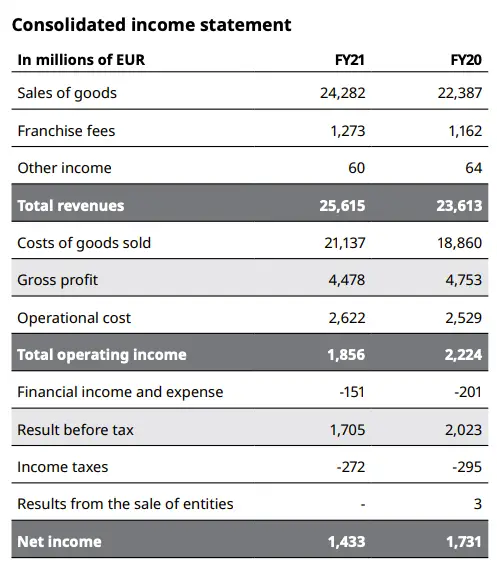

In FY21, IKEA made EUR 25.6 billion in revenue from franchise fees, sales of goods, and other income, up from the 23.6 billion made in FY20. Here’s a segment-wise breakdown of revenue.

However, if we were to include the income from IKEA’s online division and services to customers, total sales in FY21 amounted to EUR 41.9 million. In FY20 & FY19, IKEA’s total revenue stood at EUR 39.6 million and EUR 41.3 million.

IKEA Acquisitions

Being a traditional offline retailer, IKEA was a little late to adopt the relatively newer strategy of making acquisitions to retain market share and expand market dominance.

Nevertheless, IKEA has made three acquisitions since 2017, namely Task Rabbit, Geomagical, and Veja Mate. To explain what the three companies do briefly, task rabbit connects customers who need a helping hand to assemble furniture with contractors, Geomagical is an augmented reality home designing tool & Veja Mate is an offshore wind farm supposed to help IKEA reach its sustainability targets.

Read More Case Studies

Tesla Business Model Case Study

Quora Business Model Case Study

Shopify Business Model Case Study