In my opinion, Paypal’s business is worth studying for two main reasons.

First, PayPal is one of the oldest fintech companies to have survived to date in the post-internet era, so it has democratized innovations as well weathered competition from other startups since its founding in 1998. And Second, it was founded by the members of what is now famously known as the Paypal Mafia, a group of high-impact individuals like Peter Thiel, Elon Musk, Reid Hoffman, etc.

To add more weight to the two reasons stated above, what makes Paypal an even more fascinating business case study is that the company was a part of eBay, from its 2002 acquisition to 2015. But it became an independently traded company after an investor activist named Carl Icahn championed an effort to break apart the two over misaligned incentives of both companies.

In this blog, we’ll trace Paypal’s journey from the beginning, learn about the hacks it employed to jack up its growth engine and how it makes money.

Paypal’s Founding & Growth Story

Most of us might not know this, but Paypal was a spinoff from Confinity, a company founded to develop security software for handheld devices.

Since the original business model didn’t yield success, the Confinity team switched to working on a digital wallet ( a product called Paypal, which was then under the Confinity umbrella )

The early version of Paypal allowed users to send money through their handheld devices and email, but the service soon caught the attention of eBay users, who mainly were settling transaction payments via cash or cheque. Online card payments were a hassle back then. Using Paypal, however, users could & easily transfer money over the web. Soon, Paypal became the predominant mode of payment on eBay, piggybacking off the platform to grow in the broader online payments space.

At around the same time, a company called X.com, founded by Elon Musk, was gaining traction as an online payment service. Both Paypal & X.com were running a referral program that paid users to sign up & invite friends to onboard users. Had the two companies continued burning cash to compete with each other to acquire users, they might have “run out of money,” according to David Sacks, who was Confinity’s COO at the time. So, Confinity & X.com merged, and the joint entity was later called Paypal.

Meanwhile, watching Paypal’s increasing adoption on its platform, eBay purchased a startup called Billpoint, an online money transfer service, intending to turn it into the preferred method of settling online payments on eBay. However, Paypal won the battle against Billpoint, leading to eBay eventually acquiring Paypal for $1.5 billion in 2002. Paypal was conducting 70% of the online transactions on eBay at the time of the acquisition, and more than 15 million users were using the service on a standalone basis.

In 2015, 13 years later, eBay spun off Paypal into a separate, independent entity because, by that time, the payment landscape had evolved enough that the partnership between the two companies was yielding diminishing returns.

At its core, eBay was still an e-commerce company. On the other hand, Paypal’s majority revenue was coming from off-eBay transactions, accelerated by the growth in mobile payments. The disconnect meant that the management’s need to prioritize eBay’s needs misaligned with PayPal’s growth opportunities.

Since its split with eBay, Paypal took a different approach with competitors to expand its market share. It entered into partnerships with old competitors like Visa & Mastercard and tech goliaths like Google, Apple, Instagram & Amazon.

Before these partnerships, Paypal would encourage its users to link their bank account with Paypal directly to avoid the transaction fees charged by credit card intermediaries like Visa & Mastercard. The partnership removed unnecessary friction for Paypal users. According to the partnership agreement, Paypal also receives financial incentives from Mastercard & Visa based on the volume of transactions it processes.

On the other hand, the partnership with tech giants, even though it cuts into Paypal’s transaction fee, opens the door for Paypal to access a huge audience.

Paypal also expanded into the offline payment space and made multiple acquisitions to increase its user base globally. Notable ones include Hyperwallet for $400 million, Braintree for $800 million, Xoom Corporation for $890 million, iZettle for $2.2 billion & Honey for $4 billion, which is Paypal’s largest acquisition to date.

Paypal Business Model

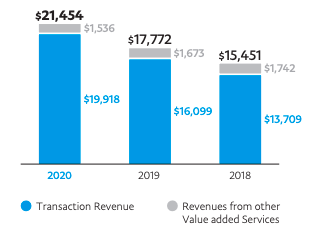

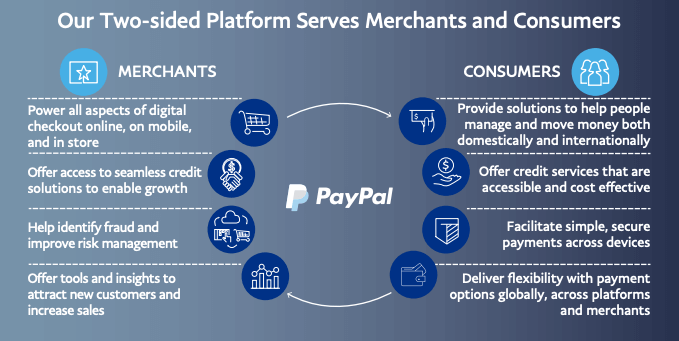

Paypal makes money from two different revenue categories: transaction revenues & other value-added services. Transaction revenues include fees charged to merchants and consumers based on total payment volume (“TPV”). Other value-added services include revenue from partnerships, subscription fees, gateway fees, interest and fees on merchant loans, and interest on customer balances.

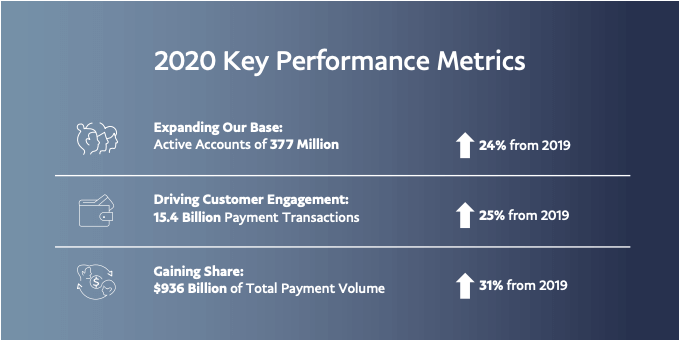

To assess yearly business performance, Paypal keeps track of three key metrics: active accounts, Number of Payment Transactions & Total Payment Volume, all three of which trended upwards in 2020.

Paypal’s business is a classic example of a two-sided network, wherein the more customers and merchants use the service, the more valuable the entire ecosystem gets.

In its 2020 financial report, Paypal highlighted that the service was connecting 377 million active merchant and customer accounts across more than 200 markets, of which 348 million were active customer accounts & 29 million were active merchant accounts.

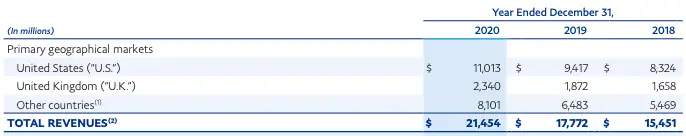

As far as Paypal’s geographical revenue breakdown is concerned, around 51.3% of revenue in 2020 came from the US market, 10.90% came from Uk, and the remaining 37.75% came from other countries.

Is Paypal Profitable?

Paypal has been profitable for a long time, but profits have drastically increased since it separated from eBay in 2015.

Here’s a breakdown of how much profit the company has made every year since 2012.

Read More Case Studies

Shopify Business Model Case Study

Quora Business Model Case Study

IKEA Business Model Case Study