When you begin to list down the reasons why one should study the business of Salesforce, the list seems endless.

Salesforce practically pioneered the SaaS model. Salesforce displaced the existing incumbent of its time to become the leading CRM software. As of 2021, Salesforce was still the #1 CRM software with a market share of 23.9%. Salesforce’s closest competitor, Oracle, had a market share of 5.5%, followed by Microsoft and SAP, which have a 5% market share each.

I could list many more reasons why the Salesforce business case study is worth studying, but that would be a time kill. So, let’s get straight to the point.

To give you a brief overview, I will run you through how Salesforce went from being an ant to a giant, the industry-defining innovations it came up with along the way, break down Salesforce’s business model, and wrap up by sharing funding & valuation information.

Salesforce Founding & Growth Story

When Salesforce started in 1999, it was not that CRM software was not yet a thing. A company called Siebel Systems was the leading CRM provider at the time. But a significant drawback in Siebel Systems’ offering and that of other software providers was that the software had to be updated and installed on-premise. This method of distribution not only made software expensive but also led to inefficiencies. For example, two people in the same company might have the same software version installed due to delays in software updation by one of the parties.

Salesforce solved the distribution problem by making its software accessible via a web browser, allowing customers to buy its CRM software on a subscription model. This new model made Salesforce one-tenth times cheaper than Siebel Systems and removed the inefficiencies of the on-premise software model.

The first product launched by Salesforce, now called Sales Cloud, made the work of sales teams easier by allowing them to track potential sales opportunities and closed deals.

In the fiscal year ending 31st Jan 2001, two years after it started, Salesforce revenue hit $5.4 million despite having weathered the dot-com bubble storm in 2000. After hitting $22.4 million in revenue in the fiscal year ending 31st Jan 2002, revenue doubled in the following two years. In 2004, Sales went public on the New York Stock exchange, raising $110 million at $11 per share.

In the year following Salesforce’s listing, Oracle bought Seibel Systems for $5.85 billion to save Seibel’s drowning boat and bolster its offering to compete with Salesforce. Salesforce’s sales automation software was beating the competition, and its number of customers was growing, but the company did not rest on its laurels.

In the same year, Salesforce came up with another industry-defining innovation called the AppExchange. The closest analogy one can use to explain the mobile operating system market.

The phone operating system market, dominated by Android & iOS, has become a force to reckon with because it has an army of third-party developers & companies working to build apps. Even though chasing the incentive to make money for themselves through apps, these developers and companies make the mobile ecosystem more valuable.

Salesforce’s AppExchange, like Android and iOS app stores, allows third-party developers to build apps that Salesforce customers can use. An example could be a document signing app made by Adobe. These kinds of apps make the Salesforce ecosystem more valuable for customers. What’s striking about AppExchange is that Salesforce launched an app store in 2005, three years before Google & Apple launched their mobile app stores in 2008.

The AppExchange innovation was followed by another innovation of turning Salesforce into a platform. In 2008, Salesforce launched force.com (Now Salesforce Platform), using which clients could essentially build upon the Salesforce offering to add new customer features they want if their developers could do the work required.

In Jan 2009, Salesforce became the first cloud computing company to breach the $1 billion revenue mark, servicing close to 55.400 customers. In the same year, Salesforce expanded beyond its core sales software offering, launching a new product called the Sevice Cloud to help existing customers and potential ones with customer service and support automation. Later, Salesforce broadened its offering by launching the marketing cloud (Marketing Automation Software) in 2012 and commerce cloud (Ecommerce software) in 2016.

Close to a decade after its founding, Salesforce also started to use the inorganic growth method of acquiring companies. From 2008 until 2021, Salesforce has acquired 21 companies. Notable acquisitions include companies like Slack, Tableau, Mulesoft, and more.

In 2009, Salesforce also began its startup investment arm called Salesforce Ventures, a fund focussed on enterprise cloud companies. Since its launch, Salesforce Ventures has invested in 400+ companies across 24 countries. In 2020 alone, Salesforce racked up a $2.17 billion gain on investments.

How Salesforce Makes Money

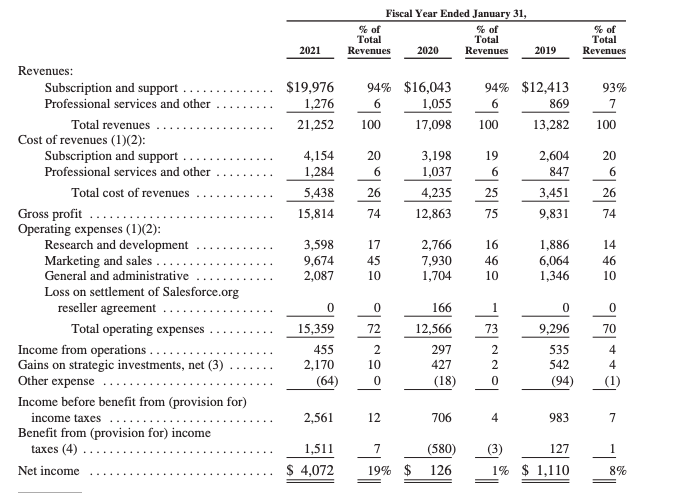

Salesforce makes money from two segments: subscription & support revenues and professional services & others. In Fiscal 2021, Subscription and support revenues were the largest income stream for Salesforce, contributing 94% of the total revenue. The professional services and other segment accounted for the remaining 6%.

Salesforce Revenue for 2021 stood at $21.2 billion, and Net income was $4.1 billion.

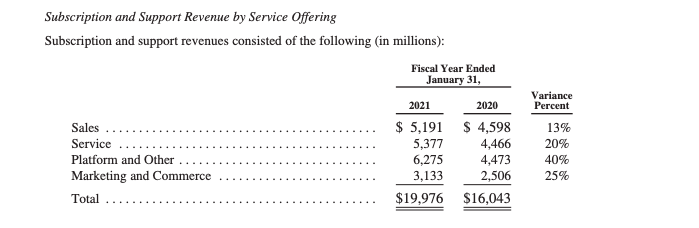

Within its broader subscription and support revenue segment, Salesforce provides four offerings: Sales Cloud, Service Cloud, Platform & Other, Marketing Cloud & Commerce Cloud.

Sales Cloud, Salesforce’s oldest and main offering, has historically driven the highest revenue for Salesforce amongst the four segments, but it fell to the third position behind Service Cloud and Platform segments. In 2021, Sales Cloud generated a revenue of $5.1 billion.

Service Cloud, Platform & Other, Marketing & Commerce Cloud made revenues of $5.3 billion, $6.2 billion & $3.1 billion respectively.

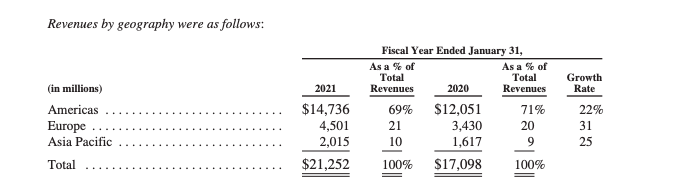

In terms of geographical breakdown, most of the revenue was driven from the Americas ( North and South America ), followed by Europe & Asia Pacific.

Salesforce Funding, IPO & Valuation

Salesforce went public in 2004. Prior to going public, the company had raised $65.4 million across 6 funding rounds.

Since August 2020, Salesforce stock has been trading at a price of $200 plus.

With a valuation of 210.51 billion, Salesforce is the 50th most valuable company worldwide according to companiesmarketcap.

Read More Case Studies

MasterClass Business Model Case Study

Doordash Business Model Case Study

Telegram Business Model Case Study