When one thinks about the early 2010s ecommerce revolution in India, or even the relatively recent D2C (direct to consumer) boom, the logistics industry; which was the backbone of this revolution, is seldom spoken of. One of the reasons is that the backend operations are usually less visible and the other is that logistics is largely considered a boring industry. But this boring Indian logistics industry was pegged at $200 billion as 2021 and is expected to grow exponentially in the future.

Delhivery, India’s largest and fastest-growing fully-integrated player by revenue in Fiscal 2021, realized that the Indian logistics industry held massive potential way back in 2011, in the year the company was founded. In this blog, I will walk you through how Delhivery become India’s leading logistics player despite the presence of incumbents like Bluedart, explain Delhivery’s business model, and wrap up the piece by sharing noteworthy information about its upcoming IPO.

Delhivery Founding & Growth Story

Prior to starting Delhivery, three of the company’s co-founders were working as consultants in Bain & Company. Three years into their job, they decided to take a sabbatical and give a shot at starting out on their own.

While researching what to work on, the logistics industry stood out the most. Two of the co-founders, Sahil Barua & Suraj Saharan, who lived across the street from each other with a logistics company in between, conducted a fun experiment of sending a book to each other. The logistics company informed them it would charge Rs 250, but still deliver the package day after tomorrow. On looking more deeply, the founders realized that the logistics industry operated inefficiently, and there was a huge scope of improvement.

Initially, Delhivery started as a hyperlocal delivery startup, helping restaurants deliver packages to customers. Zomato was just a restaurant listing site back then and Swiggy was not yet founded. However, they soon that there was an even bigger opportunity in delivery packages for ecommerce companies and pivoted to serve them.

The pivot to helping ecommerce companies deliver their good to customers turned out to be a masterstroke. With the ecommerce revolution beginning to take place in India, consumer expectations shifted — they now expected the delivery to reach them as quickly as possible.

Existing logistics players had not anticipated the logistical demand that would get created by the ecommerce boom, so they had not upgraded to serve these new players. Delhivery, a new-age startup, with a tech-focussed approach saw the perfect opportunity to disrupt older players. It partnered with the large ecommerce players, co-developing the product with its potential customers’ basis the feedback they gave.

The new ecommerce giants faced three main challenges — long delivery times, lack of real-time visibility on package delivery, and long cash delivery cycle. Existing logistical solutions took up to 30 days to return the payment collected from customers to ecommerce companies.

Delhivery solved all three problems. It gradually developed a pan India delivery network, choosing to use a decentralized model for its distribution centers instead of the age-old hub and spoke model, which slowed down delivery. It gave real package visibility to ecommerce players using technology and built an online payment system that reduced the cash delivery cycle to less than 5 days.

In the early days, Delhivery operated using the scale slowly philosophy to get the fundamentals right. It took 12 months to build their first distribution center. The second distribution center took 2 months. Once Delhivery had created the distribution center launch playbook, it was able to launch new ones in as few as 3 to 5 days.

As Delhivery’s customers grew, it also expanded into providing more logistics-related services like warehousing, transportation services, and cross-border logistics. While Delhivery focused on serving business for almost 10 years, it has also recently started customer-to-customer parcel delivery, wherein anyone like you and me can send anything from anywhere to someone else within India.

Since its inception, Delhivery has fulfilled over one billion orders across India. The company has a pan India network with a presence in every state, serving 17000 pin codes with the help of its 86 gateways, 80+ fulfillment centers, and 66000 employees.

The company has a diverse base of 21000 active customers like e-commerce marketplaces, direct-to-consumer e-commerce players, and enterprises and SMEs across different verticals like FMCG, consumer durables, consumer electronics, lifestyle, retail, automotive and manufacturing.

On its website, Delhivery mentions its vision is to ‘build the operating system for commerce’. In the future, the company would most probably look to deepen its existing offerings, expand its set of logistical services, and pursue international expansion.

Delhivery Business Model

Delhivery primarily makes money from five business segments: parcel delivery for businesses, consumer to consumer parcel delivery, freight services(truckload & partial truckload), warehousing, cross-border logistics. As of 2020, parcel delivery accounted for 55% of the revenue, freight services in 30 to 35% of the revenue, and the remaining 10% came from warehousing and cross-border logistics.

The lion’s share of Delhivery’s parcel delivery revenue comes from Indian ecommerce biggies like Amazon, Flipkart, and more. However, with larger e-commerce players looking to build in-house logistical capabilities, Delhivery’s parcel revenue is expected to shift to smaller upcoming direct-to-consumer ecommerce companies that prefer to outsource logistics. Delhivery’s parcel delivery business has the capability of delivering up to 10 kg consignments with the same-day and next-day and long-distance orders in 48-96 hours. Delhivery’s freight, warehousing, and cross-border services are geared towards serving large businesses.

Delivery has also created a TL freight brokerage platform, “Orion,” which connects shippers with fleet-owners and suppliers of truckload capacity across India. Delhivery’s primary revenue segments also make money from smaller & secondary revenue segments like insurance, loading, unloading, cash-collection fees, etc.

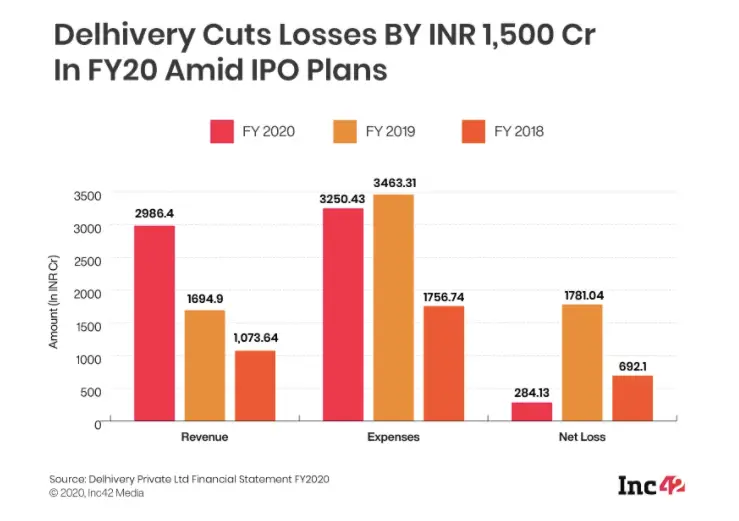

As of writing this, Delhivery is yet to turn profitable. In FY20, Delhivery reported a revenue of Rs 2986.4 crores and expenses of Rs 3250.4 crores, leading to a net loss of Rs 284.13 crore. In FY19, Delhivery had generated a revenue of 1694.9 crores after spending Rs 3463.31, making a net loss of Rs 1781.04.

The Rs 284.13 crore of net loss Delhivery made in FY20 is the lowest since FY18.

Delhivery Funding, Valuation, Acquisitions & IPO

In its more than ten years of existence, Delhivery has raised a total of $1.4 billion of funding, spread across 13 rounds. After its last fundraise of $100 million from FedEx in Dec 2021, Delhivery was valued at $3.41 billion.

In 2021 alone, Delhivery acquired three companies — Transition Robotics, Spoton Logistics & Primaseller.

In Jan 2022, the Securities and Exchange Board of India (SEBI) approved Delhivery’s proposed Rs 7460 crore IPO offering. In its draft red herring prospectus ( DHRP ) filed in November 2021, Delhivery has mentioned it planned to raise Rs 5,000 crore through fresh issuance of shares, and the IPO will also have an offer for sale (OFS) component of Rs 2460, wherein some of the companies existing investors will sell part of their holdings.

Other than giving an exit to investors and employees looking to cash out, IPO funds will help the company in its other business initiatives. As per the DHRP, Delhivery plans to use Rs 2500 core for organic growth initiatives, Rs 1250 for funding inorganic growth through acquisitions and other strategic initiatives, and the remaining money for general corporate purposes.

Read More Case Studies

Udaan Business Model Case Study

PharmEasy Business Model Case Study

Spotify Business Model Case Study