In 2019, just nine years after Zerodha started, the company became the largest stockbroker in India. And this is despite the stockbroking market already having older & entrenched incumbents like ICICI Securities, HDFC Securities, Sharekhan & Motilal Oswal. What makes this achievement even more remarkable is Zerodha is a bootstrapped company, meaning it has not raised a single penny from investors.

During a time where Indian startups raised a record $38 billion in a year & valuations are soaring regardless of the reality that many of these startups are incurring huge losses without an obvious roadmap of achieving profitability, Zerodha shines like a clear outlier.

As is the case usually with outliers, Zerodha challenged the status quo and carved out a unique path in most of the areas it has touched. And all of this is what makes Zerodha a super interesting business case study — the kind you and I can take learn from.

So, in this piece, I will walk you through Zerodha’s journey from day one till today, explain Zerodha’s business model & wrap up by sharing its revenue and profitability numbers.

Zerodha’s Founding & Growth Story

Zerodha launched in 2010, but the company’s seeds were sown way back in the 1990s. In 1997, Nithin Kamath, now Zerodha CEO, first started trading in the stock market. By 2001, he had made some money in the market, but he blew up his account trading in Futures & Options, which were newly introduced in India at the time.

Because he owed a lot of money to people, he started working in a call center. But even when he was working call center shifts at night, he would still trade during the day. Nithin continued with this routine until 2005 when he met a guy at his gym who was impressed with his stock account performance. He gave Nithin the opportunity to manage his portfolio and even recommended a few of his friends to do the same.

Jumping on the opportunity, Nithin left his job and set up a portfolio advisory firm. Soon enough, Nikhil Kamath, Nithin’s brother, also a trader, joined the advisory firm. The advisory firm grew steadily in the next few years as the two brothers helped clients make money.

In 2008, the two brothers came by the idea of Zerodha when the National stock exchange(NSE) started giving away a free trading software to stock exchange members. At that time, the stock brokerage fees in India were sky-high. The Kamath brothers had no background in technology, but they decided to disrupt the market on brokerage pricing by using NSE’s free trading platform. When Zerodha started in 2010, it became India’s first discount brokerage firm.

Instead of charging a percentage fee on the trade amount like traditional brokerage firms, Zerodha sought a flat fee of Rs 20 per trade, irrespective of the trade size.

Because it was just an online trading platform, Zerodha also did not have to hire a research team to give users buy and sell recommendations like older brokerage houses, reducing its cost of operations. And since Zerodha was disrupting the age-old brokerage pricing, the company grew organically on the back of its discount brokerage fee in its early days.

By 2012, many brokers started copying what Zerodha was doing using the same trading platform and branding, which made the Zerodha team realize that it did not have a sustainable business moat. Think of the moat as a differentiating factor that competitors would find difficult to replicate.

At that time, Zerodha’s cofounders decided that there could be no moat more valuable than the product in a tech-driven business. They hired Kailash Nadh, now Zerodha’s CTO, to level up their product game. In 2015, Zerodha ditched NSE’s free trading software it has been using since its early days & launched Kite, its proprietary trading platform.

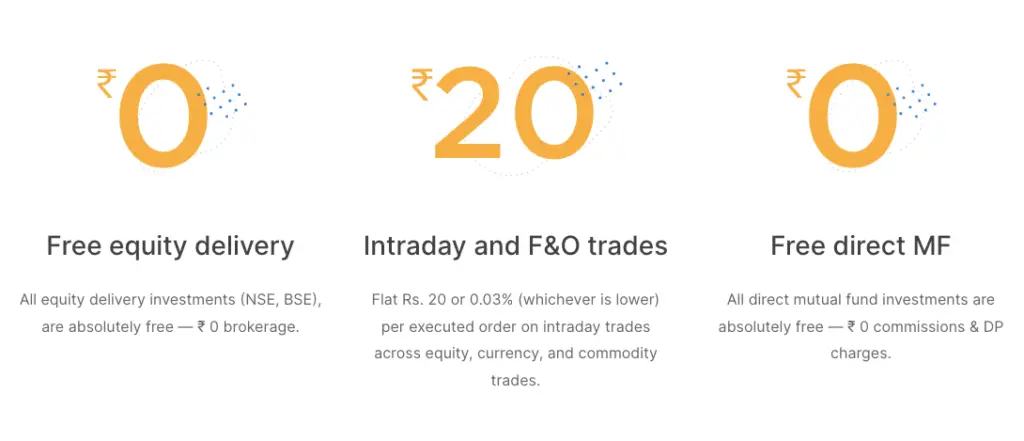

In the same year, Zerodha decided to reduce brokerage fees to zero for equity trades, in which an investor buys and holds stock for a longer duration. Zerodha retained the Rs 20 fee, but only for Intraday and Futures & Options trades.

Zerodha, as a business, went viral after adopting the zero brokerage model for equity trades. Zerodha’s unprecedented move garnered free PR from many reputed Indian media houses, turbocharging Zerodha’s growth trajectory. By 2017, Zerodha could also onboard customers entirely online thanks to Aadhar, reducing the friction involved in the signup process and further increasing the growth rate.

Between 2014 to 2017, Zerodha made a few more game-changing moves. In 2014, Zerodha launched Varsity, a free online education initiative to help anyone learn about stock markets and finance. Today, it ranks in the top three online resources worldwide for gaining capital market knowledge.

In 2015, Zerodha also started making investments in fintech startups working to grow the capital market ecosystem in India. In April 2017, Zerodha launched Coin, a new proprietary platform for direct mutual fund investment.

By 2019, Zerodha had become the largest stockbroker in India. It took Zerodha almost ten years to get to 2 million customers, which was around the time COVID hit, and only 18 months to add the following 6 million customers.

At the time of writing, Zerodha has 8+ million Zerodha clients that contribute to over 15% of all the retail order volumes in India daily by trading and investing.

Zerodha Business Model

Zerodha operates using a discount broking model, charging zero commission to customers making equity and mutual fund investments. It primarily makes money from Intraday and Future & Options trades, charging a flat Rs 20 fee or 0.03% (whichever is lower).

But one can only begin to understand the genius behind Zerodha’s fee structuring if they know the breakdown of equity trades vs. Intraday and Future & Options trades in the Indian stock market. In an Aug 2020 interview, Nithin Kamath, CEO of Zerodha, shared that only 1% of the daily stock market turnover of the Indian stock market comes from equity, the kind of trades in which an investor buys and holds stock for a longer duration. 99% of the market turnover is due to Intraday and Future & Options trades.

Most of us don’t realize this because most of the people around us hold and buy stock. But intraday and F&O trading community, even though smaller and relatively hidden, contributes more to the market turnover and does so regularly.

In Zerodha’s case, this means that charging zero brokerage on equity & even mutual fund investments acts as a vehicle to drive worth of word of mouth marketing to attract equity customers, who could potentially also make intraday and F&O trades. And even if they don’t, the deep penetration of Zerodha in the trading world makes intraday and F&O traders more likely to use Zerodha.

Apart from making money on Intraday & F&O trades, Zerodha runs Rainmatter, a fintech-focused incubator, to primarily fund Indian fintech startups. Under this initiative, Zerodha provides well-equipped workspaces, mentorship, and funding ($100K-$1M) to innovative startups targeting the capital markets space in exchange for minority stakes. Rainmatter serves two purposes — it helps grow the capital market system in India, which eventually benefits Zerodha in the form of more customers and makes Zerodha money in the process of doing so.

Zerodha Revenue, Profits & Valuation

In FY21, Zerodha made a profit of Rs 1000 crore. In FY20, the discount stock brokerage had reported a profit of Rs 440 crore on the back of a 15% revenue growth to Rs 1093 crore. The company has posted profits of Rs 350 crore on a Rs 950 crore revenue in FY19. As is evident from the numbers, Zerodha has consistently grown its revenue and profits year over year.

During its last ESOP buyback program in November 2021, Zero valued itself at a conservative $2 billion. Zerodha considered a 15x profit after tax multiple to arrive at the valuation.

To give you a sense of Zerodha’s success, BYJU’s, India’s highest-valued startup at $21 billion, reported a loss of Rs 262 core on a revenue of Rs 3022 crore in FY20.

In 2021, Nithin Kamath dismissed plans of a Zerodha IPO, reasoning that the company did not need to raise capital to grow. But going by Zerodha’s profitability numbers, Zerodha would surely be a coveted stock if listed on the market. After all, Zerodha’s business still has immense growth potential because close to 95% of Indians have not invested in stocks yet.

Read More Case Studies